Understanding the Impact of Bear Markets on the Crypto Industry

The recent downturn in the cryptocurrency market has led to a significant decline in prices, with Bitcoin falling to levels of $86,000 to $87,000. This has resulted in record outflows from spot Bitcoin ETFs, with over $2.5 billion leaving these funds in November. The headlines are filled with stories of the “institutional era” being a mirage, and the obituary writers are back at work. However, it’s essential to understand that bear markets don’t kill crypto; they kill the myths that never deserved the capital they attracted.

The Pattern of Bear Markets in the Crypto Industry

In every cycle, the same pattern plays out: prices rise on stories that sound good in a bull market, and a sharp decline shows how poor those stories were. The 2018 crash was the industry’s first real audit, with Bitcoin falling more than 80% from its peak in late 2017 as the ICO bubble burst and thousands of token sales fizzled out with no product or governance. The COVID panic in March 2020 followed the same scenario, with Bitcoin losing more than a quarter of its value in a day and halving in 48 hours as leveraged exchanges like BitMEX faced mass liquidations.

Then came 2022, when the market turned to its own idols. TerraUSD’s algorithmic “stablecoin” collapsed, wiping out $40 billion to $45 billion in a matter of days and proving that clever calculations cannot replace actual reserves. The founder has since pleaded guilty to fraud. FTX soon followed: A $32 billion exchange exposed itself as a leveraged hedge fund with a marketing budget, triggering a wave of bankruptcies among lenders and funds that had all bet on “risk-free returns.”

The Meme Era Meets Its Margin Call

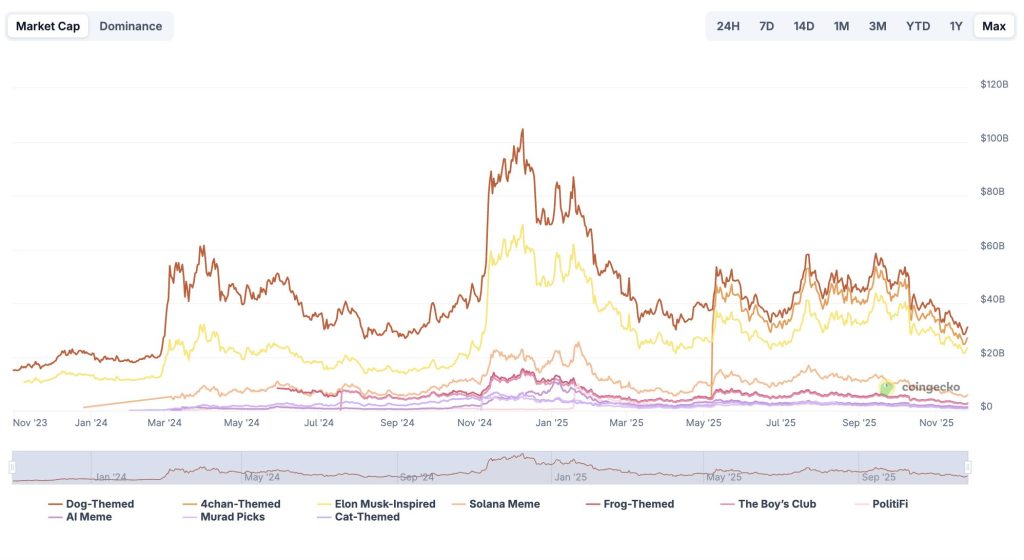

Today’s downturn is no different. What is being priced out is not crypto itself, but the idea that meme coins, celebrity tokens, and “AI-powered dog money” define the space. In 2024, meme coins reached a maximum market cap of around $137 billion before collapsing to a third of that as insider dumps and political tokens imploded. And this resistance spilled over to Bitcoin and Ethereum.  Market capitalization of top meme sectors. Source: CoinGecko

Market capitalization of top meme sectors. Source: CoinGecko

The Rails Keep Expanding Under the Noise

If you look closer, a different story emerges. Stablecoins have grown from a $5 billion niche to a core settlement layer with over $300 billion in volume, processing trillions of volume per year. Some analysts expect total stablecoin transactions to be closer to $32 trillion in 2024, of which $5.7 trillion will be cross-border. Others see this as a foundation for next-generation global payments rather than a speculative side effect.

The same thing happens with tokenization. Tokenization of real-world assets is now reported to be in the tens of billions, with annual growth of over 60% and forecasts to reach trillions by 2030. The technology has progressed from pilot projects to systemic adoption. Even the largest asset manager in the world has joined. BlackRock’s BUIDL fund (a tokenized US dollar liquidity fund) has surpassed $2.5 billion and is used as collateral on major exchanges.

Bear Markets as Forced Product Valuations

Bear markets feel less like funerals and more like trials. They force builders to justify why their token exists in order to prove who would use their protocol if the price fell another 50%. They turn “roadmaps” into liabilities and make usage data the only thing that matters. They also eliminate bad narratives. With Terra, risk-free 20 percent returns died. Trust this centralized genius with your deposits at FTX. The current cycle is busy mining every meme and you will be early.

Conclusion

So when people ask whether this bear market will “finally” kill cryptocurrencies, the answer is simple: it will destroy stories that were no longer credible the moment liquidity dried up. It will destroy the idea that every celebrity token and dog coin earns capital. But it will not destroy the rails that already move trillions of dollars, nor the tokenization stack adopted by global financial giants. For more information, visit https://cryptonews.com/exclusives/bear-markets-dont-kill-crypto-they-kill-hyped-narratives/