MyX Finance Faces Scrutiny Over Airdrop Fairness After Sybil Accusations

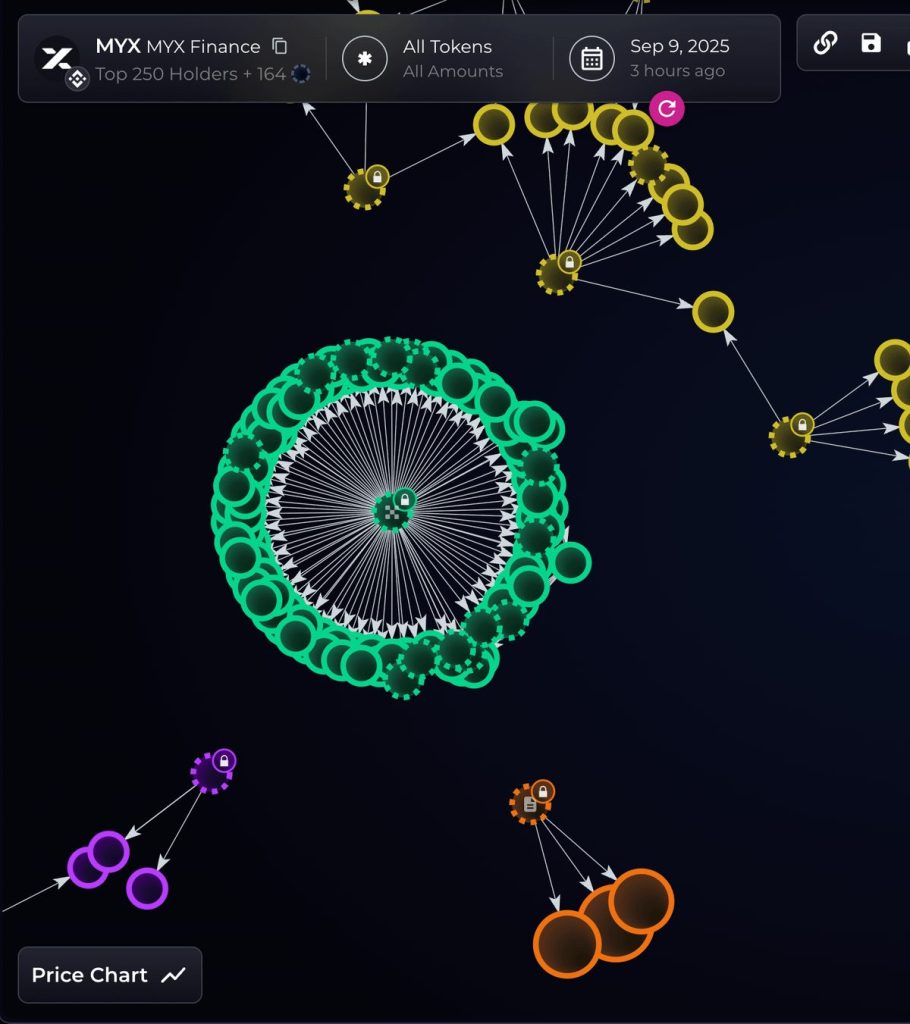

The blockchain analysis company Bubblemaps has raised concerns about a possible record-breaking sybil attack, targeting around 100 newly created wallets that received MyX tokens worth $170 million during a recent airdrop. According to Bubblemaps, these wallets secured 9.8 million MyX tokens, which corresponds to about 1% of the token supply.

Breaking: A company claimed $170 million from $MyX Airdrop

We pursued 100 freshly financed addresses with exactly the same on-chain activity

The biggest Airdrop sybil ever? 🧵 pic.twitter.com/q8yhzuo7jt

BIFOREPSAPH argued that the suspicious activity appeared coordinated, with identical funds and claims patterns across the addresses. The company described the activity as “the biggest Airdrop sybil ever” and questioned the fairness of the airdrop.

MyX Finance Defends Its Distribution Process

MyX Finance reacted to the claims and defended its distribution process. In a statement, the decentralized exchange announced that it had always prioritized fairness and openness in its campaign bonuses. The platform explained that other incentive programs, in addition to their “Cambrian” campaign, in which anti-sybil measures against wash trading bots were applied, are based exclusively on the contributions of the trading volume and the liquidity provision.

As a decentralized exchange, MyX has always confirmed the principles of fairness and openness. Apart from the “Cambrian” campaign, in which anti-sybil measures were applied to the free-free campaign for bots that were traded extensively, all other campaign rewards were …

The project confirmed that some users requested changes before the start, including dealers with a high volume, but stated that such inquiries were not banned. “Even in cases in which a single company participates extensively, we recognize and respect this participation and respect them,” said MyX Finance.

Market Manipulation Concerns Grow as MyX Token Trading Surges

The $MyX token from MyX Finance started with strong dynamics, its initial Dex offer (IDO) on Binance Wallet, which was oversubscribed by 30,296% in collaboration with PancakeWap. The token quickly secured the lists in Binance Alpha Zone, Bitget, and Pancakeswap and, by May 7th, carried its 24-hour trading volume to over $51 million.

Despite the controversy, MyX continued to act actively. At the time of writing, the token was 6.47% in the last 24 hours at a price of $17.33. The number remains more than 12% compared to its all-time high of $18.52, which was reached on Tuesday.

Industry experts raise red flags about growing market manipulation in decentralized financial resources. A new Chainalysis report estimates that wash trading with ERC20 and BEP20 tokens make up to $2.57 billion on the decentralized stock exchanges in 2024.

For more information, please visit https://cryptonews.com/news/bubblemaps-warns-of-170m-sybil-attack-in-myx-airdrop-largest-ever/