Michael Saylor’s Strategy Adds 1,287 BTC, Lifts USD Reserves to $2.25B

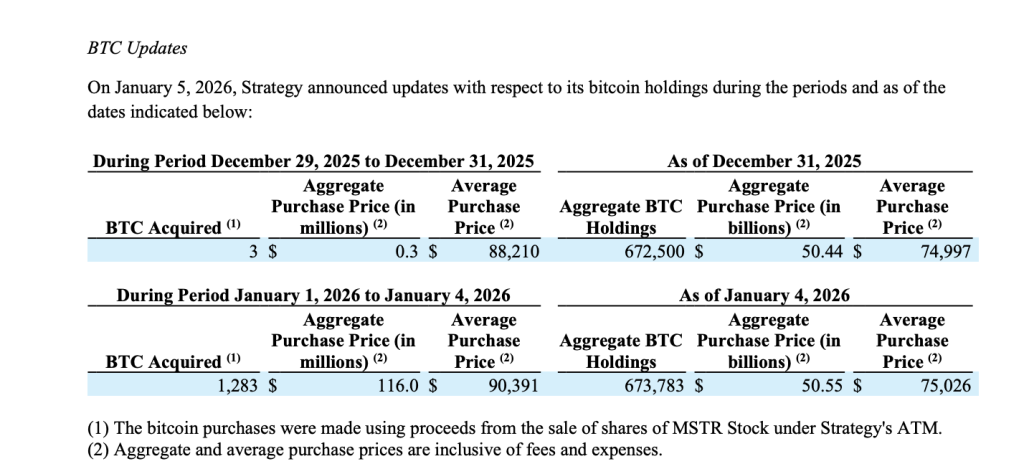

Strategy, led by billionaire executive chairman Michael Saylor, announced on Monday that it has expanded its Bitcoin treasury once again, adding 1,287 BTC in early January and lifting its total holdings to 673,783 BTC, according to a regulatory filing. The latest purchase was made between January 1 and January 4, at an aggregate cost of approximately $116 million, with an average purchase price of $90,391 per Bitcoin, inclusive of fees and expenses.

The move follows a smaller acquisition of three BTC at the end of December, showing the firm’s continued accumulation as the new year begins. As of January 4, Strategy’s aggregate Bitcoin purchase price stands at $50.55 billion, with an average acquisition cost of $75,026 per BTC across its entire treasury.

USD Reserves Rise to $2.25 Billion

Alongside the Bitcoin purchases, Strategy reports that it has also increased its USD reserves by roughly $62 million, bringing total dollar reserves to approximately $2.25 billion. The filing shows that the capital was raised primarily through the sale of Class A common stock under the company’s at-the-market (ATM) equity program. Between January 1 and January 4, Strategy reports that it sold 735,000 shares of MSTR stock, generating net proceeds of $116.3 million.

Equity Issuance Remains Key Funding Tool

The filing also details remaining issuance capacity across Strategy’s capital stack. As of January 4, the company had more than $11.3 billion in MSTR common stock available for issuance, alongside several classes of preferred stock with multi-billion-dollar issuance capacity. Strategy did not sell any preferred shares during the latest reporting period, relying instead on common equity issuance to fund its Bitcoin purchases. Net proceeds from all sales were reported after commissions and fees.

Bitcoin Holds Near $93,000 as Early-January Momentum Builds

Earlier, Bitcoin traded around $92,966, up roughly 1.8% over the past 24 hours, extending its early-January recovery after a volatile December. The move places BTC near the upper end of its recent range with buyers stepping in following a pullback from October’s all-time high near $126,000.

Bitcoin fluctuated between roughly $91,277 and $92,966, reflecting improving short-term momentum. Trading volume over the past 24 hours stood near $28.9 billion, suggesting renewed participation as the market digests macro signs and early-year capital deployment. From a broader perspective, Bitcoin’s market capitalization sits around $1.86 trillion with the circulating supply nearing 19.97 million BTC, leaving less than 1.03 million coins to be mined. Despite the recent rebound, BTC remains about 26% below its October 2025 peak, showing that the market is still in a consolidation phase rather than a full breakout. For more information, visit the original source: https://cryptonews.com/news/billionaire-michael-saylors-strategy-adds-1287-btc-lifts-usd-reserves-to-2-25b/