Michael Saylor’s Bitcoin Strategy Continues to Grow

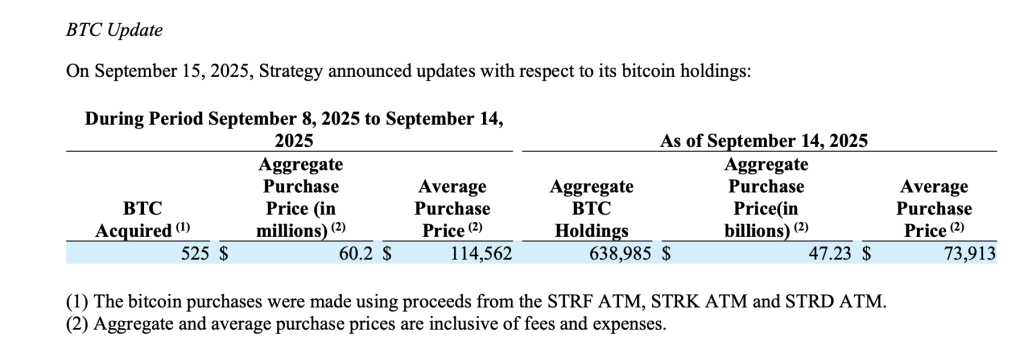

Billionaire Michael Saylor’s conviction in Bitcoin remains unwavering, as his company, Strategy, has further solidified its position as the world’s largest corporate Bitcoin holder. According to a recent filing on September 15, 2025, the firm acquired an additional 525 BTC during the period of September 8–14, at an aggregate purchase price of $60.2 million. This latest move demonstrates the company’s continued confidence in Bitcoin as its primary treasury reserve asset.

The average price paid per Bitcoin was approximately $114,562, showcasing the company’s long-term strategy of treating Bitcoin as digital gold and a hedge against inflation. As reported, this acquisition brings Strategy’s total Bitcoin holdings to an astonishing 638,985 BTC, purchased at an aggregate cost of $47.23 billion. The company’s average purchase price per Bitcoin stands at $73,913, indicating that its holdings remain strong in profit at current market valuations.

Financing Bitcoin Acquisitions

The purchases were financed through proceeds from the company’s at-the-market (ATM) equity offering programs. Over the same reporting period, Strategy sold hundreds of thousands of preferred shares across different series, raising a total of $68.2 million in net proceeds. The filing noted sales of STRF, STRK, and STRD shares, all part of the company’s broader strategy to tap equity markets and funnel the funds directly into Bitcoin acquisitions.

This structured financing model has allowed Strategy to consistently accumulate Bitcoin without over-leveraging its balance sheet. By maintaining a steady cadence of share issuance and crypto purchases, the company has managed to expand its digital asset position while retaining operational flexibility. As one of the most significant corporate holders of Bitcoin, Strategy’s approach serves as a model for other institutions looking to diversify their treasury reserves.

Strategic Outlook and Market Impact

Michael Saylor remains one of Bitcoin’s most outspoken advocates, frequently describing the asset as superior to traditional stores of value like gold. The company’s growing BTC stockpile represents not only a bold bet on digital assets but also a high-profile example of corporate treasury diversification in the modern era. As institutional adoption of Bitcoin expands and ETFs drive market inflows, Strategy’s aggressive approach continues to set it apart.

With nearly 639,000 BTC under management, the firm’s holdings are larger than the reserves of most countries, placing it in a unique position of influence within the global crypto economy. Strategy’s unwavering accumulation of Bitcoin indicates that, for Saylor and his company, digital assets are not a speculative play—but a generational hedge and a cornerstone of corporate strategy. For more information on this development, visit the original source.