Binance Launchpad Dominates the Market with 78x ROI, But Holders Are Left Behind

Binance’s Launchpad ecosystem has delivered some of the highest total returns in the market over the past year, with a current return on investment (ROI) of 12.69x and an all-time high ROI of 78.01x across 44 projects launched. However, recent data shows a growing gap between early exits and long-term holders, raising questions about how value is actually distributed across token adoption.

Data compiled by DeFi Oasis and CryptoRank shows that Binance Wallet leads all major ICO, IDO, and IEO platforms by a wide margin. The platform’s success can be attributed to its ability to master liquidity, which is a crucial factor in determining the success of a launchpad. As DeFi Oasis notes, “mastering liquidity means mastering everything.”

Launchpad Performance: A Comparison

According to the data, MetaDAO ranked second in current performance, achieving an ROI of 4.15x and an all-time high of 8.73x from seven projects. OKX Wallet followed with a current ROI of 3.22x and an ATH ROI of 34.75x, despite only launching three projects this year. Echo, founded by crypto investor Cobie and recently acquired by Coinbase in a $375 million deal, ranked fourth with a current ROI of 2.83x and an ATH ROI of 17.08x across 30 projects.

Source: DeFiOasis

Launchpad Activity and ROI

The data suggests that control over liquidity, rather than long-term token fundamentals, was the deciding factor in Launchpad’s performance. Analysts tracking these numbers say the divergence is due to timing rather than platform quality. Participants who exited their positions shortly after launch generally made profits, while those who continued to hold tokens saw their profits evaporate as liquidity decreased and selling pressure set in after launch.

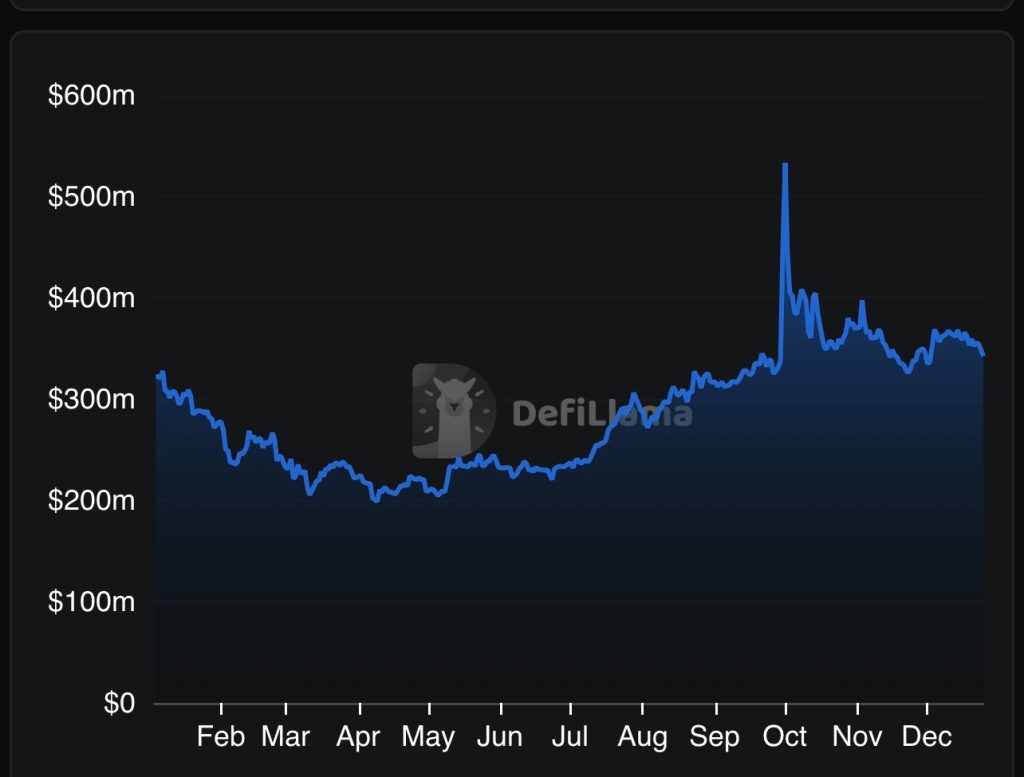

Source: DefiLlama

For more information on launchpad ROI statistics, visit Cryptonews.