Bitcoin’s Growing Share of Global Money

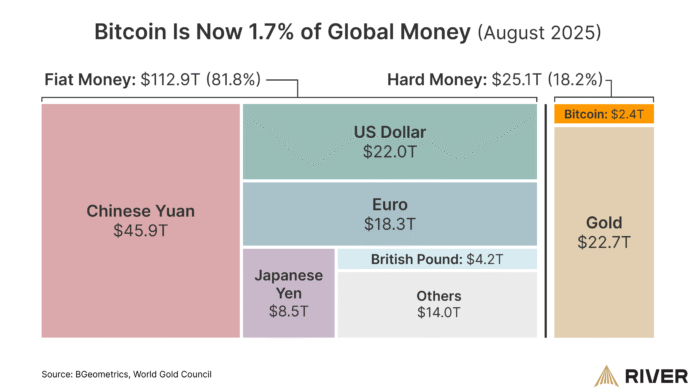

According to River, a Bitcoin financial services company, Bitcoin (BTC) has grown to account for approximately 1.7% of global money, which includes aggregate M2 money supply data for all major fiat currencies, the largest minor currencies, and gold’s market cap. This significant milestone marks a notable increase in Bitcoin’s global financial presence, with the cryptocurrency’s market capitalization topping $2.4 trillion earlier in August.

The data assumes Bitcoin’s market capitalization of $2.4 trillion, although its current market cap is around $2.29 trillion, which would bring its total share of global money down to approximately 1.66% at the time of this writing. River weighed Bitcoin’s market cap against a $112.9 trillion basket of fiat currencies and $25.1 trillion in hard money, excluding silver, platinum, and exotic metals like palladium. This comparison highlights Bitcoin’s growing influence in the global financial landscape.

Bitcoin and gold continue to claim a greater share of the global money pie as central banks around the world inflate their fiat currencies through excessive money printing, destroying purchasing power and driving investors to hard money alternatives. As a result, investors are increasingly seeking alternative stores of value, such as Bitcoin and gold, to protect their wealth from the effects of inflation and monetary expansion.

US Federal Reserve Chair Signals Rate Cuts and Monetary Expansion

United States Federal Reserve chairman Jerome Powell delivered a keynote address at the Jackson Hole Economic Symposium in Wyoming, signaling impending interest rate cuts and continued monetary expansion. Powell stated, “Our policy rate is now 100 basis points (BPS) closer to neutral than it was a year ago, and the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance.” This announcement led to a surge in Bitcoin’s price, with the cryptocurrency increasing by over 2% to reach a price of approximately $116,000 per BTC on Friday.

Bitcoin and other cryptocurrencies tend to appreciate during periods of monetary expansion, as the price of digital assets continues to correlate with global liquidity levels. According to data from the Chicago Mercantile Exchange (CME) Group, 75% of investors now anticipate an interest rate cut of 25 basis points in September. This expectation has contributed to the growing demand for Bitcoin and other cryptocurrencies, as investors seek to capitalize on the potential benefits of monetary expansion.

For more information on Bitcoin’s growing share of global money and the Federal Reserve’s monetary policy, visit the original source link: https://cointelegraph.com/news/btc-1-7-global-money-fed-chair-signals-rate-cut?utm_source=rss_feed&utm_medium=rss_tag_bitcoin&utm_campaign=rss_partner_inbound