Bitcoin’s Recovery Rally Cools Down, But Analysts Remain Bullish

Bitcoin’s (BTC) recent recovery rally to $91,000 appears to be losing momentum, but analysts believe the short-term trend for the cryptocurrency remains positive. Despite the slowdown, experts are optimistic about Bitcoin’s potential for future growth, citing key factors that could influence its price trajectory.

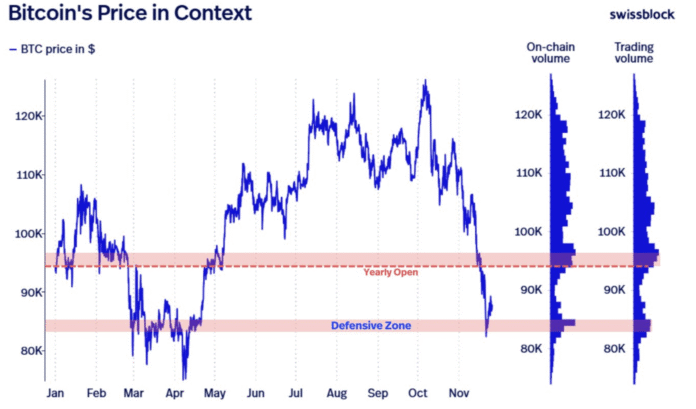

Data from Cointelegraph Markets Pro and TradingView shows that the BTC/USD pair has been trading within a narrow range of $90,300 to $92,000 since rebounding from multi-month lows of $80,000. Private asset manager Swissblock notes that Bitcoin’s break below its year-opening price of $93,300 was a significant reversal, and the bullish case for BTC now depends on maintaining a defense zone at $83,000-$85,000.

Overcoming Resistance and Reaching New Highs

To regain momentum, Bitcoin needs to clear the immediate resistance between $92,000 and $95,000. Additionally, spot volume and trading activity must recover to bring BTC back into six figures. Glassnode’s cost base distribution heatmap reveals resistance at $93,000 to $96,000, where investors acquired around 500,000 BTC. The next major barrier lies between $100,000 and $108,000, where recent buyers are expected to offer some level of resistance.

Bitcoin price chart. Source: Swissblock

Glassnode notes that breaking through the supply clusters of top buyers is crucial for getting back on track and reaching a new high. As Cointelegraph reported, bulls see $97,000 to $98,000 as the resistance zone that will confirm the recovery, with their sights set on the next target at $100,000, supported by encouraging futures market signals.

On-Chain Transfer Volume and Spot Trading Activity

The market is currently in a cooling phase, with Bitcoin on-chain transfer volume and spot trading volume declining. The seven-day moving average of on-chain transfer volume has fallen by about 20% to $87 billion over the last week. Bitcoin: Total on-chain transfer volume. Source: Glassnode

The current daily spot trading volume is around $12.8 billion, well below the cyclical peaks of this bull market. The recent rise above $91,000 was not accompanied by an increase in spot volume, reflecting lower investor engagement. Bitcoin spot volume. Source: Glassnode

An increase in spot volume, indicating stronger investor demand and market conviction, would be a positive sign for Bitcoin’s price. As Cointelegraph reported, spot markets have entered recovery mode, with Bitcoin’s cumulative volume delta (CVD) trending from negative territory back to neutral territory. If this becomes buyer dominance, Bitcoin could experience a sustained rally like that seen between May and July, when BTC price rose 32% to its previous all-time high of around $123,000.

For more information on Bitcoin’s price movements and market analysis, visit Cointelegraph.