Introduction to Cryptocurrency Market Trends

The cryptocurrency market is known for its volatility, and recent trends have been no exception. Bitcoin (BTC), the largest cryptocurrency by market capitalization, has been trading in a tight range, indicating indecision between bulls and bears. According to crypto analyst Darkfost, BTC is struggling to recover due to a lack of liquidity, especially from stablecoins. In this article, we will analyze the charts of the top 10 cryptocurrencies to identify crucial support and resistance levels.

Bitcoin Price Prediction

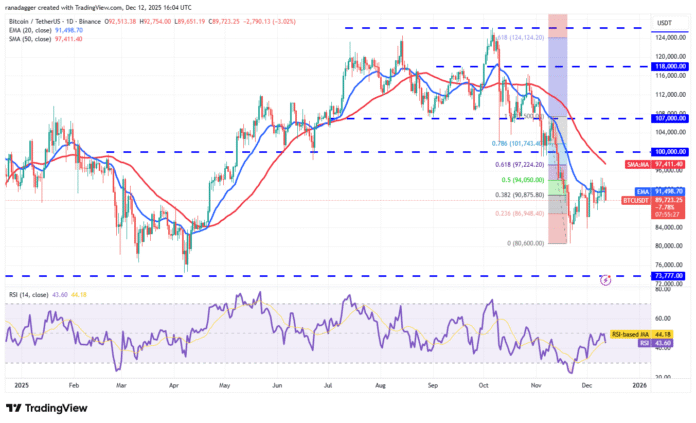

Bitcoin’s recovery is facing resistance at the 50% Fibonacci retracement level of $94,050, suggesting that bears are active at higher levels.  BTC/USDT daily chart. Source: Cointelegraph/TradingView

BTC/USDT daily chart. Source: Cointelegraph/TradingView

There is support at $87,700 and then at $84,000. A break below $84,000 opens the gates for a retest of the November 21 low of $80,600. Buyers need to push Bitcoin price above the $94,050 resistance level to signal strength. The BTC/USDT pair could then rise to the 50-day simple moving average (SMA) ($97,411).

Ether Price Prediction

Ether (ETH) turned down from the $3,350 level on Thursday and bears are trying to keep the price below the 20-day exponential moving average (EMA) ($3,125).  ETH/USDT daily chart. Source: Cointelegraph/TradingView

ETH/USDT daily chart. Source: Cointelegraph/TradingView

If they can do this, it suggests that the bears continue to be sellers during rallies. Ether price could fall to $2,907 and later to $2,716. The ETH/USDT pair could resume its downtrend with a close below $2,623.

BNB Price Prediction

BNB (BNB) has been trading near the 20-day EMA ($892) for the past few days, suggesting a balance between buyers and sellers.  BNB/USDT daily chart. Source: Cointelegraph/TradingView

BNB/USDT daily chart. Source: Cointelegraph/TradingView

The flat 20-day EMA and the RSI just below the midline suggest a range-bound move between $791 and $1,020 over the next few days. Sellers need to push BNB price below the $791 level to initiate the next phase of the downtrend.

XRP Price Prediction

XRP (XRP) remains stuck within the descending channel pattern, suggesting that the bears are in control.  XRP/USDT daily chart. Source: Cointelegraph/TradingView

XRP/USDT daily chart. Source: Cointelegraph/TradingView

Bulls need to push XRP price above the 50-day SMA ($2.25) to show strength. The XRP/USDT pair could then rally to the downtrend line, which is an important level to watch out for. A close above the downtrend line signals that the bulls are back in charge.

Solana Price Prediction

The long tail of Solana (SOL) candlestick on Thursday shows bulls aggressively defending the $126 level.  SOL/USDT daily chart. Source: Cointelegraph/TradingView

SOL/USDT daily chart. Source: Cointelegraph/TradingView

Bulls need to push Solana price above the 50-day SMA ($152) to signal a possible short-term trend reversal. The SOL/USDT pair could then rise to $172 and then to $190.

Dogecoin Price Prediction

Dogecoin (DOGE) turned down from the 20-day EMA ($0.14) on Wednesday, suggesting that bears are selling on any small rally.  DOGE/USDT daily chart. Source: Cointelegraph/TradingView

DOGE/USDT daily chart. Source: Cointelegraph/TradingView

If the price continues to decline and closes below the $0.13 support, it will signal the start of a new downward move. The DOGE/USDT pair could then fall to the October 10 low of $0.10, which is likely to attract buyers.

Cardano Price Prediction

Cardano (ADA) turned down from the $0.50 breakout level on Wednesday, suggesting that bears are trying to convert the level into resistance.  ADA/USDT daily chart. Source: Cointelegraph/TradingView

ADA/USDT daily chart. Source: Cointelegraph/TradingView

The flat 20-day EMA ($0.44) and the relative strength index (RSI) in negative territory suggest a slight advantage for the bears. There is support at $0.40 and then at $0.37. If sellers push the Cardano price below $0.37, the ADA/USDT pair could fall to $0.31 and possibly the October 10 intraday low of $0.27.

Bitcoin Cash Price Prediction

Bitcoin Cash (BCH) rose from the 20-day EMA ($560) on Thursday, indicating positive sentiment.  BCH/USDT daily chart. Source: Cointelegraph/TradingView

BCH/USDT daily chart. Source: Cointelegraph/TradingView

Bulls will aim to push the price of Bitcoin Cash above the $607 level and challenge the upper resistance at $651. Sellers are expected to defend the $651 level with all their might as a break above opens the door for a rise to $720.

Hyperliquid Price Prediction

Sellers tried to pull Hyperliquid (HYPE) lower on Thursday, but the long tail of the candle shows buying by the bulls.  HYPE/USDT daily chart. Source: Cointelegraph/TradingView

HYPE/USDT daily chart. Source: Cointelegraph/TradingView

The HYPE/USDT pair could reach the 20-day EMA ($31.91), a critical level to watch out for. If the price drops sharply from the 20-day EMA, the bears will once again attempt to resume the downtrend.

Chainlink Price Prediction

Chainlink (LINK) has been trading between the moving averages over the past few days, suggesting a balance between supply and demand.  LINK/USDT daily chart. Source: Cointelegraph/TradingView

LINK/USDT daily chart. Source: Cointelegraph/TradingView

Tight range trading is likely to be followed by range widening. If the price breaks and closes above the 50-day SMA ($14.71), it will signal that the bulls have overwhelmed the bears. The LINK/USDT pair could then rise to $19.06.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks and readers should conduct their own research when making their decision. While we strive to provide accurate and up-to-date information, Cointelegraph does not guarantee the accuracy, completeness or reliability of the information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information. For more information, visit https://cointelegraph.com/news/price-predictions-12-12-btc-eth-bnb-xrp-sol-doge-ada-bch-hype-link?utm_source=rss_feed&utm_medium=rss_tag_altcoin&utm_campaign=rss_partner_inbound