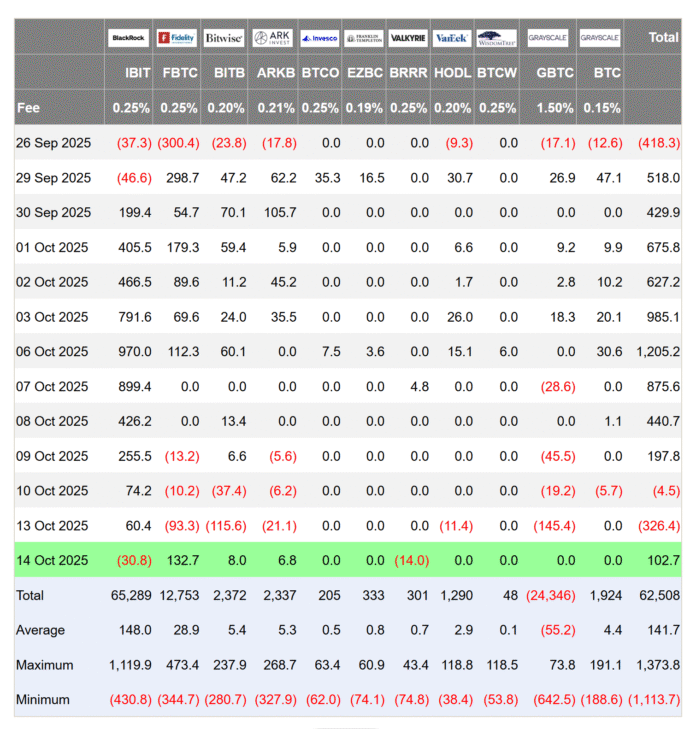

The U.S. spot exchange-traded funds (ETFs) for Bitcoin and Ether have experienced a significant rebound, with inflows recorded on Tuesday. This development comes after Federal Reserve Chairman Jerome Powell hinted at the possibility of further interest rate cuts before the end of the year. According to data from SoSoValue, spot Bitcoin ETFs saw a net inflow of $102.58 million, recovering from an outflow of $326 million the previous day.

Bitcoin ETFs Inflows

Fidelity’s Wise Origin Bitcoin Fund (FBTC) witnessed the largest gain, with inflows of $132.67 million, while BlackRock’s iShares Bitcoin Trust (IBIT) experienced a modest outflow of $30.79 million. The total net assets of all spot Bitcoin ETFs reached $153.55 billion, representing 6.82% of Bitcoin’s market capitalization, with cumulative inflows amounting to $62.55 billion.

Ether ETFs Inflows

Ether (ETH) ETFs also recorded net inflows of $236.22 million, following a sharp outflow of $428 million on Monday. Fidelity’s Ethereum Fund (FETH) led the list with $154.62 million, followed by Grayscale’s Ethereum Fund (ETH) and Bitwise’s Ethereum ETF (ETHW) with $34.78 million and $13.27 million, respectively. Spot Bitcoin ETFs turn positive. Source: Farside

Powell’s hint at potential interest rate cuts has sparked a sense of optimism in the market. Speaking at the National Association for Business Economics conference, Powell stated that the Fed may soon end its “quantitative tightening” process, noting that reserves are “somewhat above levels” consistent with sufficient liquidity. Vincent Liu, chief investment officer at Taiwan-based Kronos Research, believes that a rate cut in October could lead to increased liquidity and stronger moves in cryptocurrencies and ETFs.

Crypto Market Resilience

Despite the recent market crash, crypto investment products have shown strong resilience, recording $3.17 billion in inflows, according to CoinShares. The flash crash triggered by renewed tariff tensions between the US and China resulted in only $159 million in outflows, despite liquidating $20 billion in positions on exchanges. This resilience has contributed to total inflows rising to $48.7 billion in 2025, surpassing last year’s total. Liu attributes the renewed demand for digital assets to easing tariff tensions between the US and China and the devaluation trade reflected in gold’s strength.

For more information, visit https://cointelegraph.com/news/bitcoin-ether-etfs-rebound-as-powell-signals-rate-cuts?utm_source=rss_feed&utm_medium=rss_tag_altcoin&utm_campaign=rss_partner_inbound