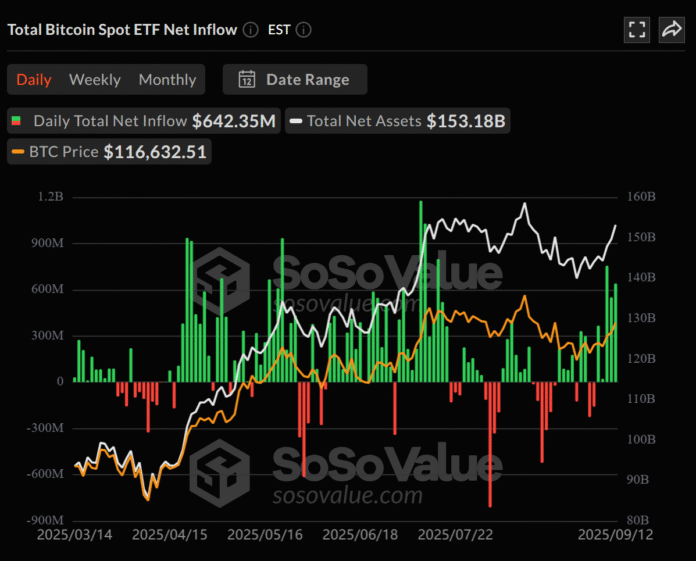

As the cryptocurrency market continues to evolve, institutional investors are increasingly turning to spot Bitcoin and Ether exchange-traded funds (ETFs) as a means of gaining exposure to these digital assets. According to recent data, these funds are experiencing a surge in inflows, with spot Bitcoin ETFs recording $642.35 million in net inflows on Friday alone, marking the fifth consecutive day of gains.

This trend is not limited to Bitcoin, as spot Ether ETFs also saw significant inflows, with $405.55 million in daily net inflows on the same day, their fourth consecutive day of gains. The total net assets for spot Bitcoin ETFs now stand at $153.18 billion, roughly 6.62% of Bitcoin’s total market capitalization, while Ether ETFs have reached $30.35 billion in net assets.

Increased Institutional Appetite for Crypto

The uptick in inflows into spot Bitcoin and Ether ETFs comes after a relatively quiet start to the month, suggesting a shift in sentiment as macroeconomic conditions stabilize and the crypto market shows signs of strength. Fidelity’s FBTC led the day with $315.18 million in fresh capital, while BlackRock’s IBIT followed with $264.71 million. Trading volumes across all spot Bitcoin ETFs topped $3.89 billion, signaling robust activity and growing institutional positioning.

Vincent Liu, chief investment officer of Kronos Research, noted that “Bitcoin and Ethereum spot ETFs keep seeing strong inflows, showing rising institutional confidence.” He added that “if macro conditions hold, this surge could strengthen liquidity and drive momentum for both assets.” This sentiment is echoed by the data, which shows that Bitcoin spot ETFs saw $2.34 billion in cumulative net inflows over the past five days.

Tokenization of ETFs on the Horizon

BlackRock, a leading asset management giant, is reportedly exploring the tokenization of ETFs on blockchain networks, following the success of its spot Bitcoin ETFs. The company is particularly interested in tokenizing funds tied to real-world assets (RWA), although regulatory challenges remain a key hurdle. Tokenized ETFs could offer new functionality, such as 24/7 trading and integration into decentralized finance (DeFi) ecosystems.

Spot Bitcoin ETFs see inflows. Source: SoSoValue

For more information on the growing trend of institutional investment in cryptocurrency, read the full article on the surge in spot Bitcoin and Ether ETF inflows and what it means for the future of cryptocurrency investment.