As the year draws to a close, the Bitcoin (BTC) market is bracing for a significant event: the expiration of $30.3 billion worth of Bitcoin options. This event is likely to have a substantial impact on the cryptocurrency’s price, with most call (buy) bets placed well above the $89,000 to $94,000 price range. In this article, we will delve into the details of the upcoming options expiration and its potential effects on the Bitcoin market.

Understanding the Options Expiration

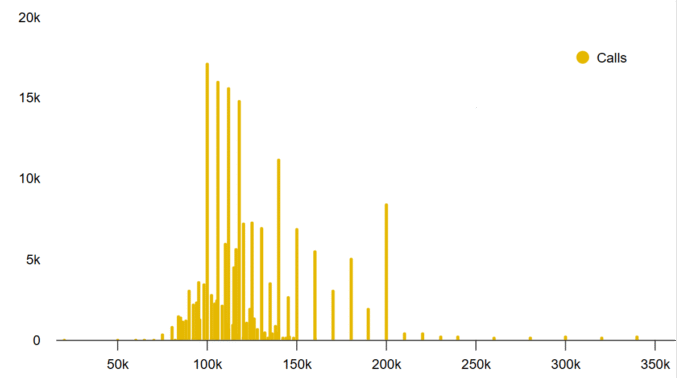

The options expiration is scheduled to take place on Friday at 8:00 a.m. UTC, and it will determine whether bears remain in control of the market after a five-week consolidation near $89,000. Deribit, a leading cryptocurrency derivatives exchange, holds 80% of the total open interest, followed by the Chicago-based CME with 11%. The majority of the $21.7 billion worth of call (buy) options will expire worthless on Friday, as bulls were caught off guard after Bitcoin lost the $100,000 psychological support level in November.

December 26: BTC call options open open interest on Deribit, BTC. Source: Deribit

December 26: BTC call options open open interest on Deribit, BTC. Source: Deribit

Bearish Strategies Remain Favored

Bearish strategies remain favored unless BTC breaks $94,000, as prices above $88,000 have wiped out more than half of put (sell) option bets. The data shows a strong concentration of call options at $100,000 to $125,000, with less than 6% of Deribit’s call options positioned at $92,000 or lower at expiration. This suggests that traders are pricing in higher chances of a Bitcoin rally, but the current market conditions do not support this optimism.

Dec 26 BTC put options open interest at Deribit, BTC. Source: Deribit

Dec 26 BTC put options open interest at Deribit, BTC. Source: Deribit

Investors Become Cautious

Investors are starting to become more cautious about risks in the technology sector, especially after Oracle’s (ORCL US) debt protection costs rose to their highest levels. The company has issued nearly $26 billion in bonds this year, according to Bloomberg. Oracle shares remain 40% below their September all-time high. This caution is reflected in the Bitcoin market, where bearish strategies are favored unless the price breaks $94,000.

Bitcoin Bulls Continue to Build Positions

Despite the current market conditions, Bitcoin bulls continue to build positions before the end of the year. Investors are pricing in higher chances of US stimulus after Treasury Secretary Scott Bessent confirmed plans to provide a $2,000 tariff rebate for non-wealthy individuals in early 2026. In addition, US President Donald Trump has made it clear that whoever replaces Fed Chair Jerome Powell in May should prioritize cutting interest rates.

Bitcoin Options Open Interest Changes in Seven Days at Deribit, USD. Source: Laevitas.ch

Bitcoin Options Open Interest Changes in Seven Days at Deribit, USD. Source: Laevitas.ch

Key Price Levels to Watch

The price of Bitcoin will play a crucial role in determining the outcome of the options expiration. Below are four likely BTC year-end options scenarios at Deribit expiration based on current price trends:

-

$86,000 to $90,000: The net result favors put (sell) instruments by $2.4 billion.

-

$90,001 to $94,000: The net result favors the put (sell) instruments by $1.5 billion.

-

$94,001 to $96,000: The net result favors the put (sell) instruments by $650 million.

-

$96,001 to $98,000: Balanced result between call and put options.

A break below $90,000 on Friday would be extremely negative for Bitcoin bulls. However, as long as Bitcoin price remains below $94,000, the odds remain in favor of bearish options strategies. For more information on the Bitcoin market and the upcoming options expiration, visit Cointelegraph.