Bitcoin Price Plummets to Five-Week Low, Targets $66,000 Support Level

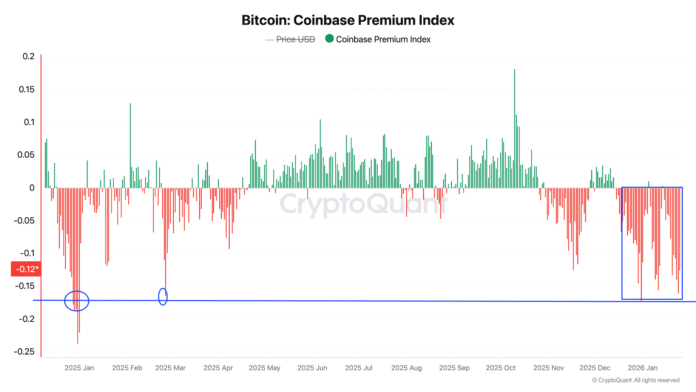

Bitcoin (BTC) has extended its downward trend, reaching a five-week low of $86,000 on Sunday. This decline may potentially lead to a retest of the macro low of $66,000, a crucial support level established in November 2024. The cryptocurrency’s momentum has faltered, with the Bitcoin Coinbase Premium Index hitting a 12-month low, indicating strong US spot selling pressure.

The Coinbase Premium Index, which measures the price difference between BTC on Coinbase and Binance, has been negative for over five weeks, reflecting a significant discount on Coinbase compared to other major exchanges. According to derivatives data provider CoinGlass, “The Coinbase premium continues to decline sharply and expand, indicating significantly stronger BTC selling pressure on Coinbase compared to other exchanges.” CryptoQuant analyst TeddyVision notes that the index’s persistent negativity is associated with “capital exodus from US exchanges and little sign of aggressive dip buying by long-term holders.”

US Spot Demand Weakening, Institutional Outflows Rise

The decline in US spot demand is accompanied by a sharp increase in institutional outflows. US-based spot Bitcoin ETFs have recorded approximately $1.72 billion in outflows over the past five days, while crypto investment products have seen outflows of over $1.7 billion last week. This bearish sentiment is further reinforced by the negative Coinbase Premium Index, which has historically been associated with price declines. For instance, when the index remained negative between December 18, 2024, and January 5, 2025, BTC price declined by 18% over the same period.

Bitcoin Coinbase Premium Index. Source: CryptoQuant

Bitcoin Coinbase Premium Index. Source: CryptoQuant

Technical Analysis: Bitcoin Price Targets $66,800

Veteran trader Peter Brandt has marked a “sell” signal after the BTC/USD pair confirmed a bearish technical pattern. Brandt’s chart suggests that if the price fails to reclaim the $93,000 level as support, there is a greater downside risk. The pattern’s measured target is $66,800, a 22% decline from the current price, which is roughly in line with previous BTC price highs from 2021 and 2024.

Spot Bitcoin ETFs flow table. Source: Farside Investors

Spot Bitcoin ETFs flow table. Source: Farside Investors

BTC/USD daily chart. Source: Peter Brandt

BTC/USD daily chart. Source: Peter Brandt

For more information, read the full article on Cointelegraph.