Bitcoin Price Compression: A Prelude to Expansion?

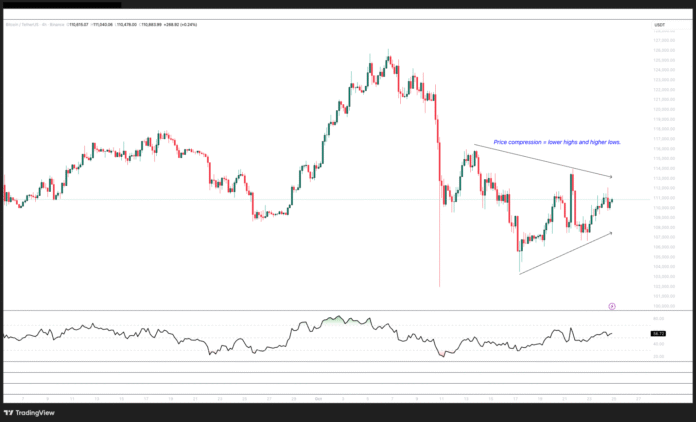

Bitcoin (BTC) traders have been engaged in a heated debate throughout the week, with sellers limiting price breakouts to $112,000 and buyers defending declines into the $107,000-$108,000 range. Despite concerns about BTC’s inability to sustain prices above $112,000, the range compression observed in the four-hour and daily higher lows and lower highs could be a positive sign. This phenomenon is often referred to as “compression before expansion” in technical analysis, where volatility falls and prices consolidate after a major market move, such as the October 10 sell-off that saw BTC open interest fall by 50%.

Some analysts have expressed concern about the implications of this compression, but others see it as a sign of impending expansion. The BTC/USDT four-hour chart shows the range compression, with higher lows and lower highs, indicating a potential buildup of energy for a future price move.

Positive Developments Underlying Daily Price Action

Despite the range-bound price action, there are some positive developments underlying the daily price action, suggesting that BTC will eventually return to the $120,000 price zone. On Tuesday, spot Bitcoin ETFs raised $477 million as BTC price rose from $107,500 to $114,000. Additionally, data shows that spot buyers from the order size cohorts on the Binance and Coinbase exchanges are buying across the entire range from $101,500 (Binance) to this week’s range high (114,000), as seen in the Cumulative BTC/USDT volume deltas for spot and futures contracts.

Glassnode’s Bitcoin Accumulation Trend Score metric also shows a value of 0.924, indicating that larger units or a significant portion of the network are accumulating BTC. The trend score metric for Bitcoin accumulation suggests that the current range consolidation could be a sign of impending expansion.

Macro Economic Calendar Events and Their Impact on BTC Price

Several analysts agree that the Bitcoin range consolidation could come to an end early next week, and altcoins could begin to recover as the US macroeconomic calendar is filled with a list of events. As Negentropic noted, there are several factors that could contribute to a potential price explosion, including the termination of QT, gold’s distribution phase, macro stabilization, and a potential deal between China and the US. With $7.4 trillion in money market funds about to launch, the stage is set for a potential BTC price surge.

This article is for general information purposes and is not intended to constitute, and should not be construed as, legal or investment advice. The views, thoughts, and opinions expressed herein are those of the author alone and do not necessarily reflect the views and opinions of Cointelegraph. For more information on Bitcoin price compression and its potential impact on the market, visit https://cointelegraph.com/news/bitcoin-price-compression-will-spark-expansion-will-btc-explode-to-120k.