Cathie Wood: Bitcoin’s 4-Year Cycle May Be Broken Due to Institutional Adoption

Ark Invest CEO Cathie Wood has sparked a heated debate in the cryptocurrency community by suggesting that Bitcoin’s well-known four-year cycle may no longer be relevant. According to Wood, the increasing adoption of Bitcoin by institutional investors is altering the asset’s long-term behavior, leading to reduced volatility and shallower drawdowns. In an interview with Fox Business, Wood stated that the sharp crashes that were once characteristic of the Bitcoin market, often resulting in 75% to 90% declines, are becoming less common as large financial players accumulate the asset.

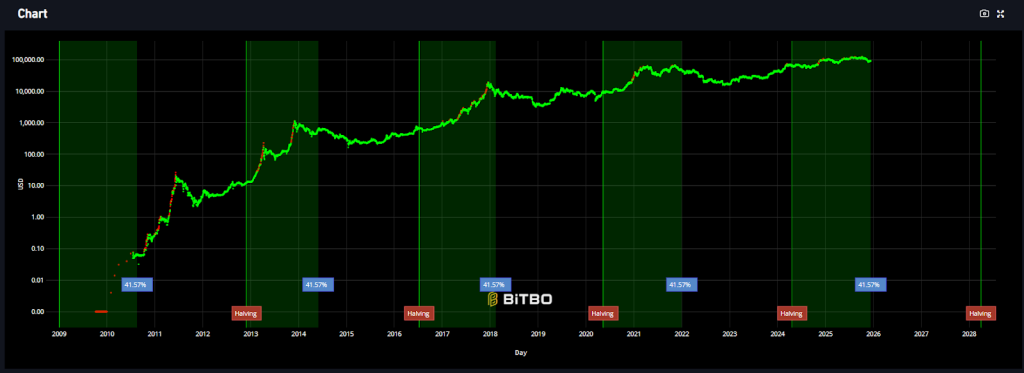

Wood’s comments challenge the traditional market expectations that have been in place for over a decade. Bitcoin’s cycle has historically followed its halving events, which occur roughly every four years and reduce the block reward. However, Wood argues that the market’s behavior has shifted, with Bitcoin now trading more like a risk-on asset, moving in line with equities and real estate rather than acting as a hedge. “The volatility’s going down,” she said, adding that institutions “are going to prevent much more of a decline.” Wood also suggested that “we may have seen the low a couple of weeks ago.”

A Growing Debate: Is the Four-Year Cycle Finished?

Wood’s comments have sparked a wider industry debate, with analysts across major institutions weighing in on the topic. Standard Chartered, for example, has reduced its 2025 price target from $200,000 to $100,000, citing the reduced influence of the halving cycle on price movements. Analyst Geoffrey Kendrick noted that the pattern of prices peaking 18 months after each halving is “no longer valid.” On social media, the debate has been intense, with Bitwise CIO Matt Hougan and CryptoQuant founder Ki Young Ju both arguing that institutional inflows have effectively erased the traditional cycle.

Historically, Bitcoin has followed a rhythm of accumulation, rally, peak, and multi-year downturn. However, this time, after hitting $122,000 in July, analysts say Bitcoin’s behavior looks different, slower, and steadier, with less speculation from retail investors. Sentora executive Patrick Heusser pointed to the Bitcoin Power Law model, which views price growth as part of a long-term curve influenced by time rather than strict four-year windows. He noted that halvings still matter, but only as interruptions within a broader trend.

Bitcoin’s Market Structure Still Mirrors Past Cycles, Glassnode Argues

Not all experts agree that the four-year cycle is broken. Glassnode, for example, has published data showing that the current cycle’s structure mirrors earlier ones, including long-term holder behavior and late-cycle demand softening. Despite institutional involvement, Glassnode argued that Bitcoin’s timing still aligns closely with past multi-year peaks. As experts debate whether the cycle is broken or simply evolving, most agree that investors should expect a market defined by longer trends instead of dramatic, fast swings.

Analysts say crashes may be shallower, closer to 30% to 50% instead of the deep drawdowns of past years, but rallies may also stretch over longer periods. Strategies built around precise halving timing may no longer work with the same accuracy. Macro analyst Lyn Alden recently said Bitcoin’s current market conditions lack the euphoria needed for a major collapse, adding that broader economic forces now dictate the asset’s movement. She expects Bitcoin to reclaim $100,000 by 2026, but warned that the path there will be uneven. For more information, visit the original source: https://cryptonews.com/news/cathie-wood-bitcoin-cycle-disrupted-institutions/