Bitcoin’s Price Outlook: $108K by Weekend or Further Decline?

Bitcoin’s price has been experiencing significant volatility in recent days, with some analysts predicting a potential drop to $108K by the weekend. This comes after a weak U.S. jobs report, which showed a miss in non-farm payrolls and a jump in unemployment to 4.3%. Despite this, Bitcoin’s price initially rallied to a 9-day high of $113,384 before cooling down to $110,634.

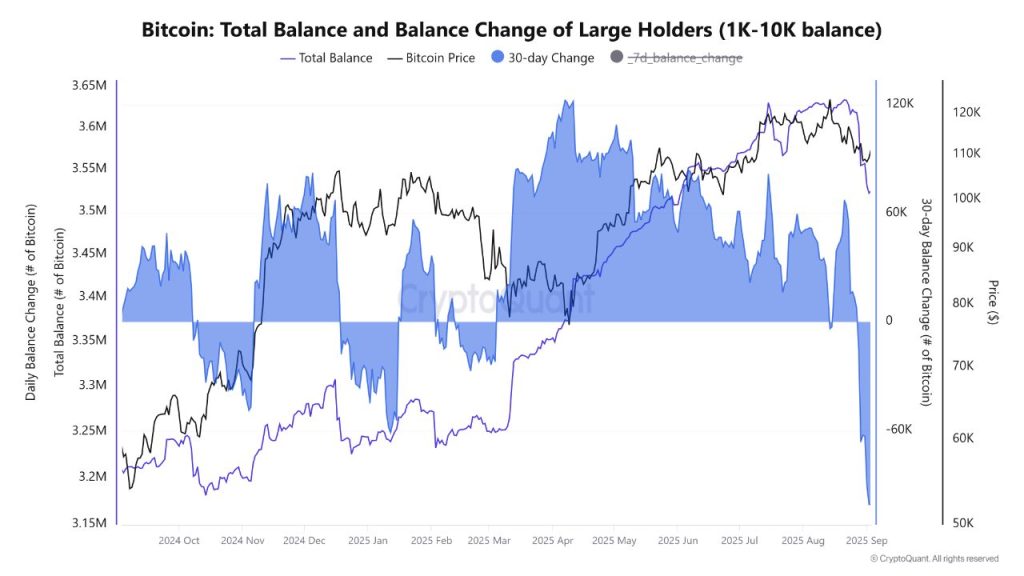

Historically, Bitcoin has reacted positively to signs of lower interest rates, as looser policy reduces pressure on risk assets and supports liquidity inflows. However, the current weakness in the market is making investors cautious, with data from CryptoQuant revealing a significant decline in whale reserves over the past 30 days. This selling pressure has been penalizing the price structure in the short term, leading analysts to believe that Bitcoin might be pushing below $108,000 this weekend.

Market Trends and Analysis

The growth of Bitcoin accumulation by corporate institutions has slowed sharply, with Strategy, the largest corporate holder of Bitcoin, seeing its monthly BTC purchases collapse from +134K in November 2024 to just 3.7K in August 2025. This decline in institutional demand has contributed to the current selling pressure, making it challenging for Bitcoin to regain its momentum.

However, market analyst Crypto Lord asserts that Bitcoin is currently printing a series of higher lows, indicating a bullish underlying trend despite short-term volatility. According to him, every dip since August has been defended, showing that buyers are stepping in earlier with every pullback. This type of structure often builds the foundation for an eventual breakout higher.

Long-Term Outlook and Expert Insights

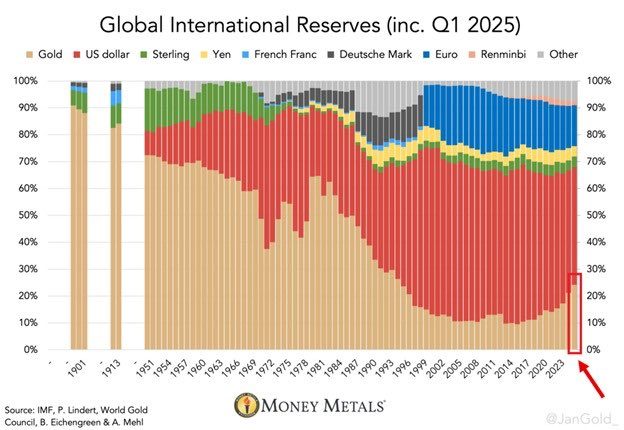

Jeff Park, Bitcoin Advisor at Bitwise Invest, recently shared his views on Bitcoin’s long-term market outlook, stating that it is very bullish. He believes that anyone who studies the history of money would see that at some point, it always resets. With the dollar losing its reserve currency status and Bitcoin continuing to play an important role in the changing monetary order, Park’s optimism is shared by many experts in the field.

Technical Analysis and Price Predictions

On the technical front, the Bitcoin 8-hour chart shows a classic Head and Shoulders pattern forming after the rally toward $125K, indicating a bearish reversal. The left shoulder, head, and right shoulder are clearly outlined, with the neckline acting as the key support level. Once the price broke below the neckline at around $113K, it confirmed the bearish structure.

Given this setup, Bitcoin looks primed for further downside, with near-term targets aligning around $107K–$105K, and deeper continuation potentially extending toward $97K if selling pressure accelerates. However, it’s essential to remember that market trends can shift rapidly, and investors should always conduct their own research and consider multiple sources before making any investment decisions.

Original source: https://cryptonews.com/news/bitcoin-falls-2-despite-rising-odds-of-fed-easing-after-weak-u-s-jobs-report-108k-btc-by-weekend/