Bitcoin ETFs Witness Significant Uptober Surge as Ethereum’s Inflow Streak Comes to an End

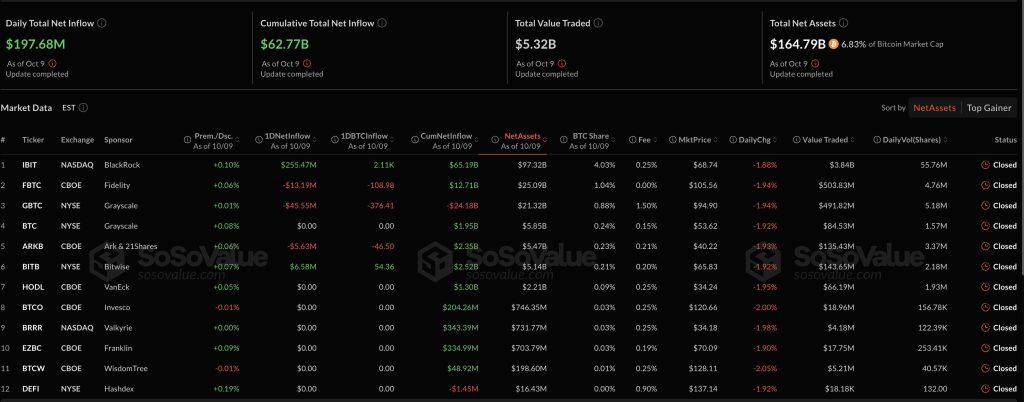

U.S. spot Bitcoin exchange-traded funds (ETFs) have continued their strong run in October, with a notable $197.8 million in net inflows recorded on October 9, according to data from SoSoValue. This surge in inflows reflects the renewed interest of institutional investors in Bitcoin, as the asset trades near its record highs. The cumulative totals for U.S. Bitcoin spot ETFs have now reached $62.77 billion, with total net assets standing at $164.79 billion and daily trading volume climbing to $5.32 billion.

Bitcoin ETFs now represent roughly 6.8% of Bitcoin’s total market capitalization, highlighting their growing role in institutional portfolios. This significant presence underscores the increasing acceptance and integration of Bitcoin into mainstream financial markets. The strong demand for Bitcoin ETFs is driven by the asset’s performance, with Bitcoin itself rising over 10% in October, peaking at $126,080 before pulling back to around $121,000.

BlackRock Leads the Charge in Bitcoin ETFs as Ethereum Products Experience a Decline

Among the notable performers, BlackRock’s iShares Bitcoin Trust (IBIT) led the inflows with $255.47 million, further solidifying its dominance in the sector with total assets now surpassing $97 billion. In contrast, Fidelity’s Wise Origin Bitcoin Fund (FBTC) saw $13.19 million in outflows, while Grayscale’s GBTC reported $45.55 million in withdrawals. This mixed performance highlights the competitive landscape of Bitcoin ETFs, with different funds attracting or losing investor interest based on their performance and investor preferences.

The strong inflows into Bitcoin ETFs this month, including a notable $1.19 billion on October 6, suggest that institutional investors are increasingly looking to Bitcoin as a viable investment option. This trend is supported by the overall growth in the cryptocurrency market, with Bitcoin and other digital assets gaining more mainstream acceptance. As regulatory environments evolve and more investment products become available, the demand for Bitcoin and other cryptocurrencies is expected to continue growing.

Ethereum ETFs Experience a Reversal After a Strong Run

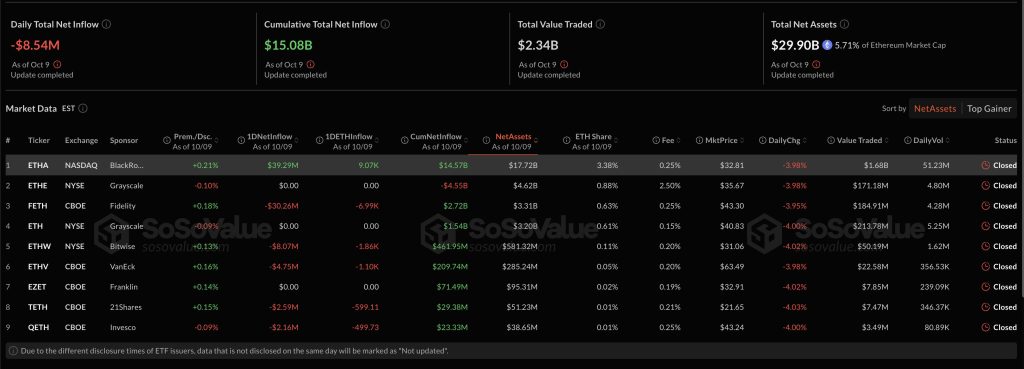

In contrast to the continuous inflows into Bitcoin ETFs, Ethereum ETFs saw their eight-day inflow streak come to an end on October 9, with $8.7 million in outflows. This reversal followed a period of consistent gains, during which Ethereum ETFs attracted over $1.8 billion in cumulative inflows. The total assets for Ethereum spot ETFs now stand at $29.9 billion, with a total trading volume of $2.34 billion. BlackRock’s ETHA fund remained the top performer with $39.29 million in inflows, while Fidelity’s FETH led the outflows with $30.26 million.

Bitcoin and Ethereum Show Record Institutional Momentum

Both Bitcoin and Ethereum have demonstrated strong institutional momentum this year, driven by record ETF inflows and positive on-chain signals. Analysts believe that there is room for prices to climb toward $180,000 for Bitcoin before reaching historically “overbought” conditions. Despite sitting at all-time highs, on-chain metrics indicate a calmer and more sustained market than in past cycles, suggesting a potential for further growth.