Bitcoin and Ethereum Inflows Reach 1-Year Low as Investors Anticipate Fed Decision

According to the latest CryptoQuant Market insight, Bitcoin and Ethereum exchange inflows have dropped to a 1-year low, indicating reduced selling pressure and investor reluctance to exit positions ahead of a potential U.S. Federal Reserve rate cut. The average BTC deposit per transaction has also halved from 1.14 BTC in mid-July to 0.57 BTC in September, indicating reduced sell pressure from larger holders.

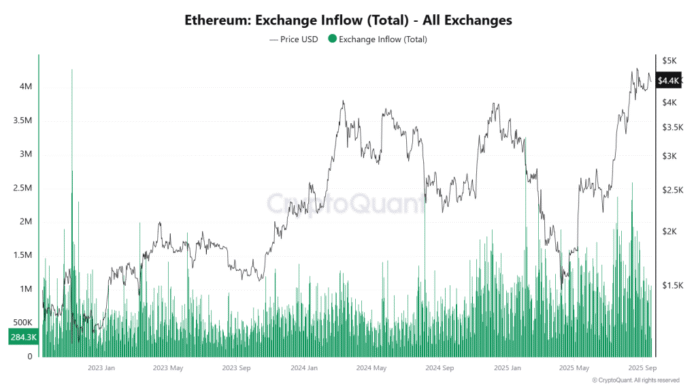

Ethereum inflows into exchanges mirror this trend, sitting at a two-month low with the 7-day average down to 783K ETH, from 1.8 million ETH on August 15. The average ETH deposit size has similarly declined from 40–45 ETH per transaction at previous peaks to just 30 ETH today, reflecting the same low sell-side activity observed in BTC.

Meanwhile, stablecoin deposits, particularly USDT, have risen sharply, showing that investors are building dry powder for potential buying opportunities following the Fed’s announcement. Julio Moreno, head of research at CryptoQuant, noted that stablecoin net deposits, particularly for USDT, have surged, reaching $379 million on August 31, the highest level year-to-date.

Technical Analysis: Bitcoin Lower Channel Breakout Targets $128K-$132K

Crypto analyst Rekt Capital shared that Bitcoin needs just one daily close and successful post-reclaim retest of ~$117,200 to confirm a return into the blue daily range at $120k and resume another leg of the bull run. On the technical front, the Bitcoin daily chart shows several key patterns converging to suggest a bullish outlook.

Bitcoin is currently trading at $116,465, positioned within a well-defined ascending channel that has guided price action since May. The chart shows Bitcoin has successfully tested and held the lower boundary of this channel multiple times, demonstrating strong institutional support around the $108,000-$111,000 zone.

After hitting resistance near the first resistance target around $125,000 in August, Bitcoin consolidated and pulled back to retest support, typical healthy price action in a bull market. The recent bounce from the channel’s lower boundary suggests this pullback may be complete.

Historically, whenever Bitcoin has closed September in green, October and November have been extremely bullish, with an average combined gain of 35%. With the current trend and technical analysis, Bitcoin is expected to break through the initial resistance cluster and reach the target zone of $128,000-$132,000.

For more information, visit the original source: https://cryptonews.com/news/bitcoin-ethereum-inflows-hit-1-year-low-as-crypto-investors-brace-for-fed-decision-btc-eyes-120k/