Despite a strong week of inflows into Bitcoin exchange-traded funds (ETFs), derivatives data suggests that traders remain cautious about the cryptocurrency’s prospects. The annualized premium for Bitcoin 60-day futures has been relatively stable, indicating that trader confidence has not improved significantly. This is reflected in the monthly Bitcoin futures, which are trading at a 7% premium compared to spot markets, a level that is typically seen during periods of strong optimism.

The lack of confidence among traders is also evident in the delta skew in Bitcoin options, which climbed to 8% on Friday, indicating that traders are concerned about the risk of a price decline. This concern is not unfounded, given the current macroeconomic environment. The rise in gold prices to a record high of nearly $4,050 on Wednesday, for example, suggests that investors are seeking safety amidst growing economic uncertainty.

Macroeconomic Risks Weigh on Bitcoin

The US-China trade tensions have been a major contributor to the uncertainty, with US President Donald Trump accusing China of imposing new port fees on rare earth exports and threatening a “massive increase” in Chinese import tariffs in response. The S&P 500 index fell 1.9% as investors grew concerned that escalating trade war tensions could hit corporate profits, particularly in the artificial intelligence sector. Bitcoin’s correlation with the S&P 500 remains significant, with the 40-day rolling ratio currently sitting at 73%, indicating that traders’ appetite for risk is heavily influenced by fears of an impending stock market downturn.

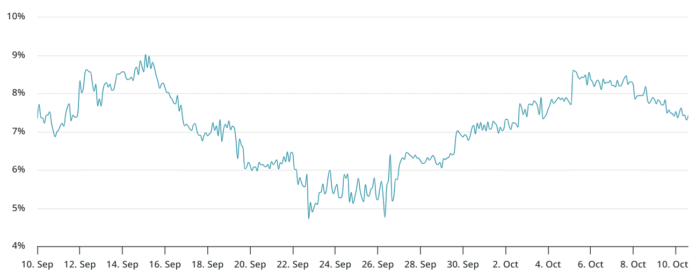

The fall in one-year U.S. Treasury yields to 3.61%, near their lowest level in more than three years, also suggests that investors are accepting lower yields despite ongoing inflationary pressures. The U.S. personal consumption spending index rose 2.7% year-on-year in August, the highest in six months, and analysts expect prices to rise in 2026 as import tariffs take effect. Annualized premium for Bitcoin 60-day futures. Source: laevitas.ch

Stablecoin Demand Offers Insights into Trader Sentiment

Stablecoin demand in China offers valuable insights into traders’ positioning. As investors rush to exit the cryptocurrency market, stablecoins typically trade at a discount of 0.5% or more compared to the official US Dollar/CNY exchange rate. Bitcoin options 25% delta skew (put call) at Deribit. Source: laevitas.ch

Tether, for example, has been trading at a slight discount since Wednesday, suggesting traders were cashing out earlier as Bitcoin struggled to maintain bullish momentum. However, the indicator returned to parity after BTC fell below $120,000, suggesting that traders are no longer interested in exiting the crypto market. Tether (USDT/CNY) vs. US Dollar/CNY. Source: OKX

Banks Consider Launching Stablecoin Pegged to G7 Currencies

Despite impressive net inflows of $5 billion into Bitcoin spot exchange-traded funds (ETFs) in October, confidence remains subdued as macroeconomic risks remain elevated. BTC derivatives metrics show that traders are still hesitant to turn bullish, leaving room for Bitcoin price to fall further. For more information, visit https://cointelegraph.com/news/bitcoin-derivatives-scream-caution-despite-a-week-of-strong-btc-etf-inflows?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound

One-year US Treasury bond yield. Source: TradingView / Cointelegraph