Bitcoin’s Abrupt Sale: Understanding the Recent Price Drop

Bitcoin’s (BTC) sudden sale from its all-time high of $124,474 initially seemed like a routine outcome, considering that some investors always take profit at new heights and others open shorts simultaneously. However, the correction of 6.72% below $115,000 may be lower than expected, leading some analysts to predict a further decline to $110,000.

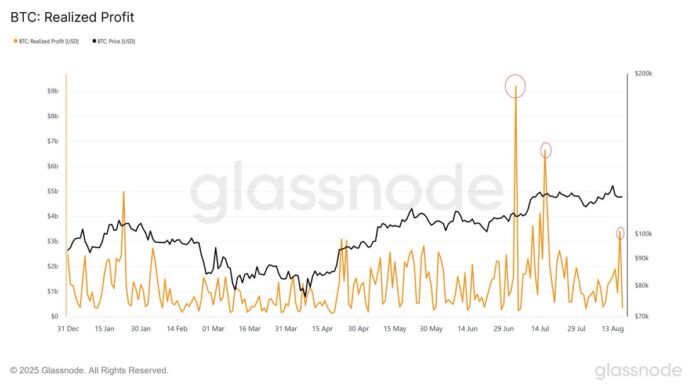

The recent sale was analyzed by European research manager Andre Dragosch, who published a table showing that short-term owners have increased, but their numbers have also decreased over time. Dragosch noted, “Note: YES in recent times we (from short-term owners) increased. But they have also become smaller over time.”

Liquidity Dynamics and Price Movement

Shubh Varma, co-founder and CEO of Hyblock, explained that the recent price movement was driven by liquidity dynamics. Varma stated, “Last week we saw a clear pattern of liquidity dynamics that drives Bitcoin weekend price measures. In the weekend, the liquidity was built down (Fig. 1), and creates visible pools of potential liquidation goals. When the weekend has been completed, this liquidity recording balance (Fig. Liquid excavations were more susceptible.”

Varma further explained that this “liquidity size” appeared in the order book and Onchain. The large ETH-unstakes events have added to the available supply, while the demand from Digital Asset Treasuries (DATS) has remained strong during the weekdays.

Institutional Demand and Price Recovery

According to Varma, the institutional demand seemed to dry out as Wall Street closed shop for the weekend, exposing the imbalance. Varma noted, “We saw this both in the metrics order book and in slippage (Figure 3). The liquidity sits below, slippage sting and both 1% and 2% BID-ASS-depth thrown bears. This combination triggered a cascade that swept the highlighted liquidation zones.”

When asked about the possibility of additional disadvantages, Varma stated, “Massive quantities of open interest were opened at about the same time as liquidity. It will serve as good support, as both longs and shorts were opened there and the shorts are currently caught.”

This article does not contain investment advice or recommendations. Every investment and trade movement is a risk, and readers should carry out their own research before making a decision. For more information, visit https://cointelegraph.com/news/bitcoin-liquidity-zones-swept-but-uptick-in-open-interest-hints-at-btc-recovery?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound