Bitcoin Mining Industry Faces Unprecedented Economic Downturn

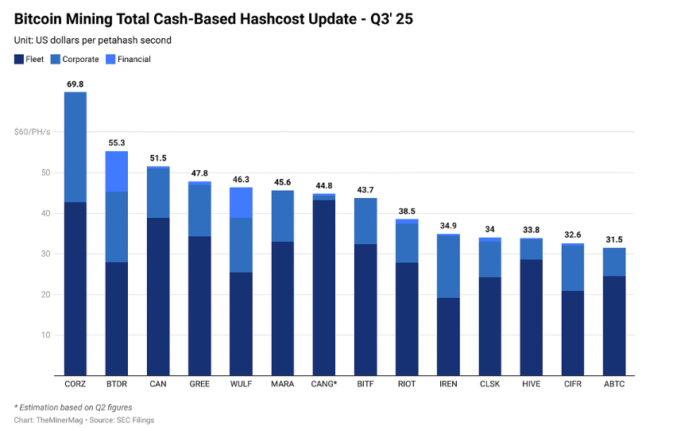

The Bitcoin mining industry is experiencing its most severe economic downturn in its 15-year history, with even large publicly traded operators struggling to break even amid collapsing mining revenue and rising debt. According to a report by TheMinerMag, miners are operating in the “harshest margin environment of all time,” with hashprice, the revenue earned per unit of computing power, falling from an average of about $55 per petahash per second (PH/s) in the third quarter to roughly $35 PH/s.

This significant decline in hashprice is attributed to the sharp correction in the price of Bitcoin (BTC), which fell from a record high near $126,000 in October to below $80,000 in November. As a result, cost-per-hash has become a crucial metric for miners, highlighting how efficiently they convert electricity and capital into raw computational output. The data reveals a widening gap between average operators and the most efficient survivors, with new-generation mining machines now requiring more than 1,000 days to recoup their costs.

Bitcoin mining costs across major publicly traded miners. Source: TheMinerMag

The deteriorating economics have led to a shift toward deleveraging and liquidity preservation, with CleanSpark’s recent decision to fully repay its Bitcoin-backed credit line with Coinbase serving as a prime example. TheMinerMag notes that “balance sheets are reacting” to the changing landscape, with miners focusing on preserving their financial stability.

Impact on Bitcoin Mining Stocks

The decline in Bitcoin prices and the resulting pressure on hashrate have coincided with a broader sell-off across traditional markets, delivering a significant blow to publicly listed mining companies. TheMinerMag’s third-quarter report highlights a “sharp drawdown in mining equities since mid-October,” with losses accelerating across the sector.

MARA stock’s year-to-date performance. Source: Yahoo Finance

MARA Holdings (MARA) has been among the hardest hit, down roughly 50% from its Oct. 15 closing high. CleanSpark (CLSK) has declined 37% over the same period, while Riot Platforms (RIOT) has dropped 32%. Shares of HIVE Digital Technologies (HIVE) have suffered the steepest decline, plunging 54% from their October peak.

Expert Insights and References

For more information on the Bitcoin mining industry and its current challenges, readers can refer to the original report by TheMinerMag. Additionally, a recent article by Cointelegraph explores the long-term security budget problem facing Bitcoin, providing valuable insights into the impending crisis. Read the full article here.