Bitcoin’s recent surge past the $114,000 mark has sparked excitement among investors, with the cryptocurrency’s price reaching its highest point in over two weeks. This upward trend is particularly noteworthy ahead of the $4.3 billion Bitcoin options expiry on Friday. To understand the potential implications of this expiry, it’s essential to delve into the details of the options market and the factors influencing Bitcoin’s price.

Options Expiry and Market Dynamics

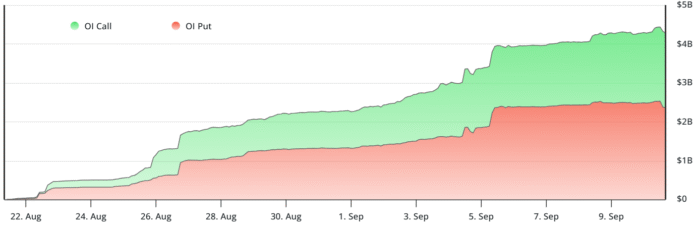

The options market is a critical component of the financial sector, allowing investors to bet on the future price of assets like Bitcoin. The $4.3 billion options expiry is a significant event, as it can substantially impact the cryptocurrency’s price. Currently, put options (bets against the price rising) dominate the market, with $2.35 billion in open interest compared to $1.93 billion in call options (bets for the price to rise). However, the recent price increase has given call options an edge, which could fuel further bullish momentum if Bitcoin sustains its current levels.

Aggregate BTC Sept. 12 options open interest, USD. Source: laevitas.ch

Deribit’s Dominance and Market Signals

Deribit, a leading cryptocurrency derivatives exchange, holds 75% of Bitcoin’s weekly expiry share, followed by OKX at 13%. Bybit and Binance account for roughly 5% each. Given Deribit’s dominance, its positioning offers valuable insights into whether Bitcoin can push beyond $120,000 in the short term. Notably, bearish or neutral positions appear poorly placed, with fewer than $125 million in put open interest set at $114,000 or higher on Deribit. In contrast, more than $300 million in call contracts would be activated if Bitcoin sustains levels above $113,000 through Friday’s expiry, providing a $175 million advantage for call buyers.

BTC Sept. 12 options open interest at Deribit, USD. Source: Laevitas.ch

Macroeconomic Factors and Bitcoin’s Upside

The recent surge in Bitcoin’s price was partly driven by Oracle Corporation’s positive earnings report, which highlighted the company’s significant investments in artificial intelligence infrastructure. However, concerns about the sustainability of AI-driven growth and the potential for recession could limit Bitcoin’s upside. The US job market, with its recent weak employment data, is also a critical factor to consider. Bank of America equity analyst Ebrahim Poonawala warned that rising unemployment could weaken credit quality at large banks, although credit losses have so far been minimal in 2025.

Source: X/sam_mielke

Ultimately, the direction of Bitcoin’s price will depend on various factors, including macroeconomic uncertainty and the options market. If Bitcoin holds $112,000 into Friday’s expiry, call options open interest will exceed put options by $50 million, supporting neutral-to-bullish strategies. However, if the price falls below $111,000, put options will gain a $100 million advantage. As the cryptocurrency market continues to evolve, it’s essential to stay informed about the latest developments and trends.

For more information on Bitcoin and the cryptocurrency market, visit the original source.