Bitcoin (BTC) has been making headlines with its recent surge, reaching over $116,000 on Friday. This upward trend is largely attributed to a combination of factors, including a fresh S&P 500 all-time high and growing expectations of a more accommodative monetary policy in the US. However, the journey to $140,000 is not without its challenges, and several factors could potentially hinder this growth.

Miners’ Accumulation Patterns and Corporate Investment

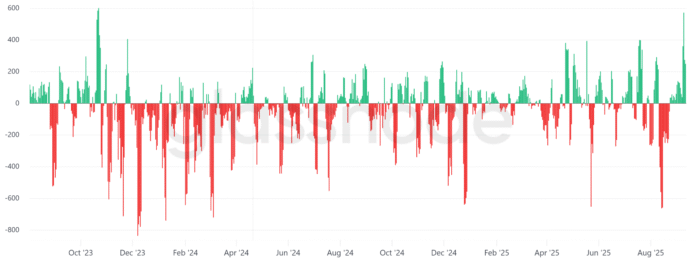

One of the key indicators of Bitcoin’s potential for growth is the accumulation pattern of miners. Data from Glassnode shows that the wallets of mining operators have been adding to their holdings for the third week in a row, with net inflows reaching a peak of 573 BTC on Tuesday. This strong accumulation is reminiscent of a similar pattern last year, which preceded a 48% price rally. The total reserves of Bitcoin held by companies have also exceeded 1 million BTC for the first time in September, according to data from Bitcointreaeasuries.net.

Corporate investment in Bitcoin has also been on the rise, with companies such as MicroStrategy (MSTR), MetaPlanet (MTPLF), and Cango Inc. (CANG) continuing to purchase the cryptocurrency. The data from Bitcointreaeasuries.net shows that the total reserves of Bitcoin held by companies have exceeded 1 million BTC for the first time in September.

Challenges to Bitcoin’s Growth

Despite the optimism surrounding Bitcoin’s growth, there are several challenges that could potentially hinder its journey to $140,000. The increasing inflation expectations of investors and a weak consumer mood could prevent BTC from reaching new heights. The survey on consumer mood by the University of Michigan showed more pessimism than expected in September, while the expectations of long-term inflation rose to 3.9% due to concerns about tariff effects.

The continued accumulation of mining operators and companies gives the Bitcoin accumulation an optimistic tone, but the fears of slowing economic growth could cause retailers to approach the coming weeks with more caution. The US Spot bitcoin ETFs increased $1.3 billion in net flows between Wednesday and Thursday, bringing total assets to $148 billion. Ishares Bitcoin Trust (IBIT) remains the clear leader with $87.5 billion, followed by Fidelity Wise Origin Bitcoin Fund (FBTC) with $23 billion and Grayscale Bitcoin Trust (GBTC) with $20.6 billion.

For context, gold ETFs, the largest tradable wealth class, hold $431 billion, while the wider gold market, according to the World Gold Council, is valued at $24.7 trillion. Even without the almost 50% of gold demand tied up in jewelry, the ETF industry from Bitcoin reflects a deeper penetration compared to its market capitalization of $2.3 trillion, although it was only introduced in 2024.

All Roads Lead to Inflation – Cut or Not, Bitcoin Can Win

Despite the potential challenges, Bitcoin’s growth is not entirely dependent on the actions of the US federal reserve. The continued accumulation of mining operators and companies, combined with the growing demand for Bitcoin ETFs, could potentially drive the price of Bitcoin to $140,000. However, it is essential to approach this prediction with caution, considering the potential risks and challenges that could arise.

This article serves general information purposes and should not be regarded as legal or investment advice. The views, thoughts, and opinions expressed here are solely those of the author and do not necessarily reflect the views and opinions of Cointelegraph or do not necessarily represent them.

Source: https://cointelegraph.com/news/bitcoin-miners-hodl-again-is-dollar140k-btc-price-next