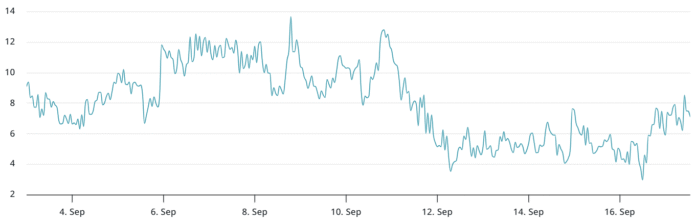

As the US Federal Reserve’s interest rate decision approaches, Bitcoin (BTC) investors are closely watching the market’s reaction. The Bitcoin Options Delta Skew has risen above the neutral threshold of 7%, indicating that put options are being traded more than call options. This shift is not extreme, but it is typically seen in bearish markets, in contrast to the neutral 5% level observed a week ago.

The Bitcoin options market is reflecting the uncertainty surrounding the US Fed’s decision, with the Delta Skew rising over the neutral threshold. The premiums paid by market participants should be examined to determine whether the higher Bitcoin options coincide with increased trading activity. Panic times are usually characterized by a strong increase in put-to-call premium, as traders seek to aggressively hedge their positions.

Bitcoin Options Hedge

The BTC options premium-to-call ratio in Deribit is currently 71%, reflecting the low appetite for neutral to necessary positioning among traders. Levels over 180% indicate extreme fear, which was last observed on April 8, when Bitcoin’s price dove under $75,000 for the first time in five months. This data contradicts the concept of a Doomsday scenario or excessive caution, as the uncertainty of the artificial intelligence sector and global trade tensions escalate.

According to the Financial Times, China’s internet regulator has prohibited the purchase of certain NVIDIA microchips. Jensen Huang, CEO of Nvidia, stated, “I am disappointed with what I see, but they have larger agendas to train between China and the United States, and I understand that and we are patient about it.” This development has added to the uncertainty in the market, with NVIDIA’s parts decreasing by 2.6% on Wednesday.

Top Traders Bullish

The boring ratio of stock exchanges’ “top trader” offers a wider market mood, as it includes futures, margin, and spot markets. Top traders’ long (bullish) positions in Binance and OKX rose on Wednesday compared to the previous day, signaling optimism for Bitcoin despite mixed signals from BTC option markets. In fact, whales and market makers expected price profits but were unprepared when Bitcoin reached $115,540.

The net inflows of $292 million in Bitcoin Spot Exchange Fund (ETFs) on Tuesday supported trader optimism and increased expectations of $120,000 and higher. However, the final result depends on the probability of a less restrictive US money policy and a further de-escalation in the debate about the import duties in the US-China trade tensions.

As the market awaits the US Fed’s interest rate decision, Bitcoin investors are advised to remain cautious and monitor the market’s reaction. The Bitcoin options market is reflecting the uncertainty surrounding the decision, and traders should be prepared for any potential outcomes. For more information, visit the source link.

Bitcoin 30-day options Delta Skew (put-call) at Deribit. Source: laevitas.ch

Bitcoin options Premium-put-to-call ratio in Deribit. Source: laevitas.ch

BTC Top Traders’ Long-Short Ratio at Binance and Okx. Source: Coinglass