Understanding the Impact of Covered Calls on Bitcoin’s Price

The recent downtrend in Bitcoin’s price has led to speculation about the role of institutional inflows and corporate accumulation in sustaining price levels. One theory suggests that the increasing demand for Bitcoin options, particularly those tied to the BlackRock iShares Spot Bitcoin (IBIT) exchange-traded fund, has contributed to the price stagnation. To better understand this concept, it’s essential to examine the mechanics of covered calls and their potential impact on the market.

A covered call strategy involves an investor selling a call option to another party, giving the buyer the right to purchase the underlying asset at a fixed price by a specific date. In return, the seller receives an upfront cash payment, similar to interest on a bond. This strategy differs from fixed income products in that the seller continues to hold a volatile asset, potentially limiting its upside potential. If the asset’s price rises above the strike price, the seller will have to sell at the lower price, missing out on additional profits.

The Shift to Options-Based Returns

The collapse of cash-and-carry trading, which involves selling BTC futures while holding a corresponding position in the spot market, has led to a shift towards options-based returns. For much of late 2024, dealers earned a consistent 10% to 15% markup, but by February 2025, this premium had fallen below 10%, and in November, it struggled to stay above 5%. In search of higher returns, funds moved into covered calls, which offered more attractive annual returns of 12% to 18%.

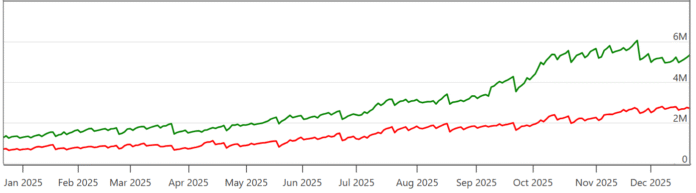

This transition can be seen in IBIT options, where open interest increased from $12 billion to $40 billion at the end of 2024. Nevertheless, the put-to-call ratio has remained stable below 60%. If widespread “suppressive” call selling were truly the dominant force, this relationship would likely have collapsed as the market became saturated with call sellers. Instead, the balance sheet implies that for every yield-focused seller, there is still a buyer positioning for a breakout.

Put-to-Call Ratio and Implied Volatility

The put-to-call ratio suggests that some participants sell upside call options, but a much larger group buys put (sell) instruments to protect themselves from a possible price decline. The recent defensive stance is reflected in the skew metric, with IBIT put options trading at a 5% premium, compared to a 2% discount at the end of 2024. At the same time, implied volatility, the market’s measure of expected turbulence, fell to 45% or less as of May, compared to 57% at the end of 2024.

Lower volatility reduces the premiums earned by sellers, meaning that the incentive to use this so-called “suppressive” strategy has actually become weaker, even though total open interest has increased. The argument that covered calls keep prices low makes little sense when the sellers of these call options stand to gain the most when prices rise toward their target levels.

Conclusion

Instead of acting as a constraint, the options market has become the primary place where Bitcoin’s volatility is monetized to generate returns. The data suggests that hedging and yield strategies go hand in hand with bullish positioning, and the put-to-call ratio implies that for every yield-focused seller, there is still a buyer positioning for a breakout. For more information on this topic, visit Cointelegraph.