Bitcoin Options Market Reveals Cautious Optimism with $300,000 Moonshots

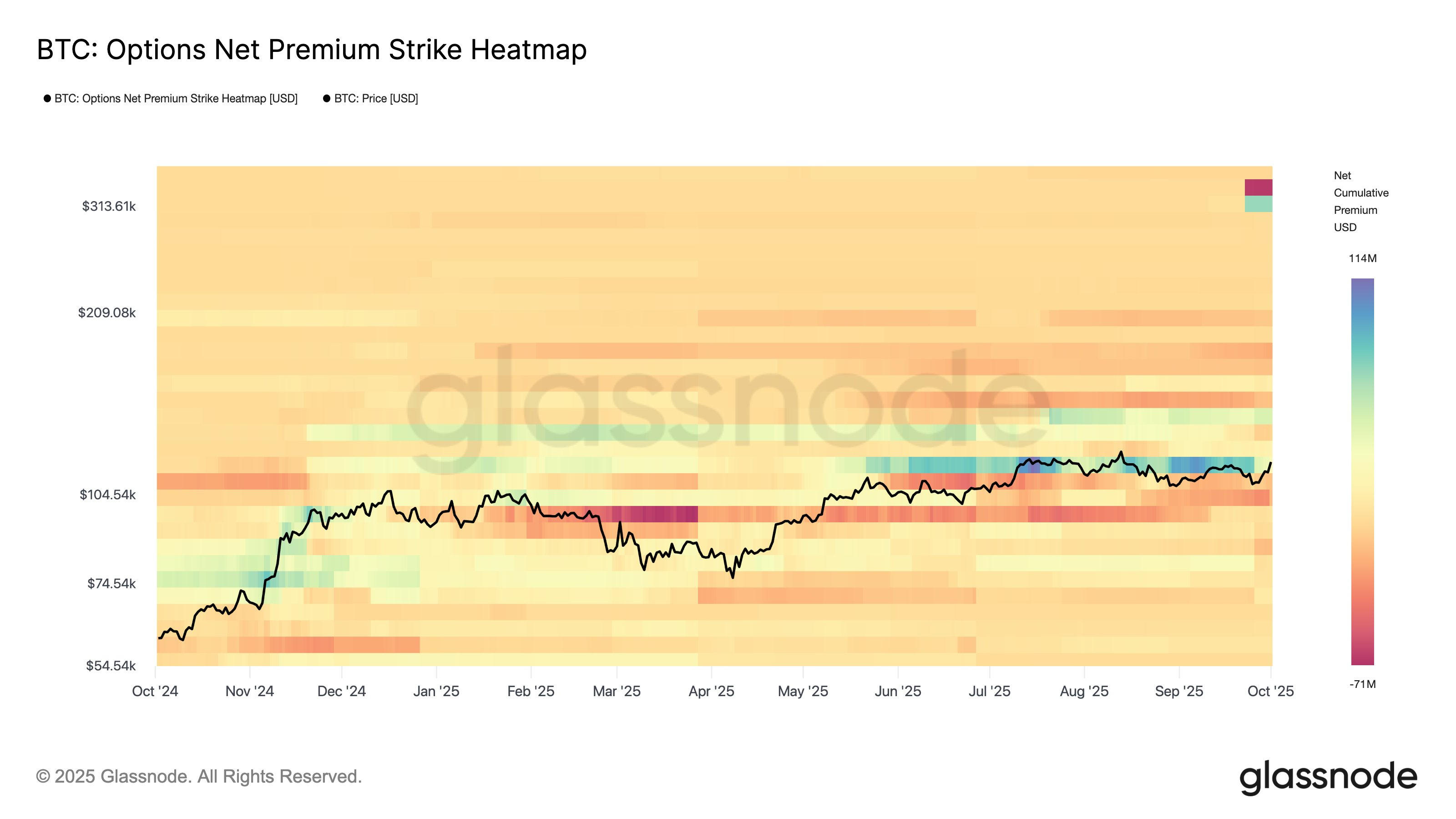

The Bitcoin options market is showing signs of cautious optimism, with most bets clustered around the $100,000 to $120,000 range, according to data from Glassnode. This range is near the current price of Bitcoin, indicating that traders expect the cryptocurrency to continue trading within this range. Additionally, there is a concentration of calls at $130,000, suggesting a positive trend in the market.

Moreover, there is growing interest in moonshot out-of-the-money options near $300,000. Although these calls are unlikely to be profitable, they are relatively cheap and reflect a growing interest in upside exposure. The state of the options market suggests that traders are cautiously optimistic about Bitcoin’s future price movements.

BTC options net premium strike heatmap | Source: Glassnode

BTC options net premium strike heatmap | Source: Glassnode

The likely reason for this optimism is the sustained inflow of institutional capital, both through treasury firms and ETFs. According to analysts at B2BINPAY, institutional capital was the likely reason behind Bitcoin’s rally past $120,000. Notably, net Bitcoin ETF inflows reached $1.3 billion on Oct. 2, reflecting a broader positive trend over the past few weeks.

Positive ETF Flows and Easing Fed ExpectationsAnalysts at B2BINPAY expect Bitcoin to test $130,000–$140,000 in the base case, supported by recovering ETF flows and easing Fed expectations. However, they also note that there is a risk of a sharp correction back to $105,000–$110,000 if macro tightening returns. If ETF inflows sustain momentum in the fourth quarter, it will likely signal the start of a new bullish cycle.

Macro uncertainty, especially due to the U.S. government shutdown, has pulled capital away from stocks and benefited gold and Bitcoin. The Bitcoin options market is reflecting this positive trend, with traders betting on upside exposure. While the $300,000 moonshot bets are unlikely to be profitable, they are a sign of the growing interest in Bitcoin’s potential for long-term growth.

Conclusion

In conclusion, the Bitcoin options market is showing signs of cautious optimism, with most bets clustered around the $100,000 to $120,000 range. The sustained inflow of institutional capital and positive ETF flows are likely reasons for this optimism. As the market continues to evolve, it will be important to monitor the trends and developments in the Bitcoin options market. For more information, visit the original source link: https://crypto.news/bitcoin-options-market-turns-bullish-with-300k-moonshots/