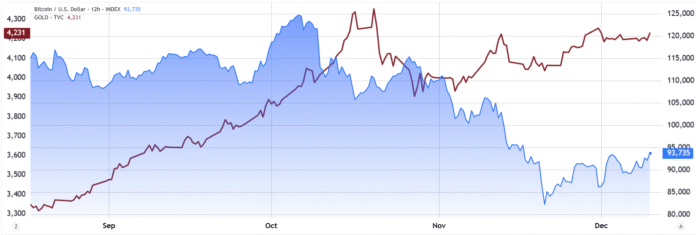

Bitcoin (BTC) derivatives markets are becoming increasingly skeptical about the cryptocurrency’s ability to maintain its upward momentum, despite the US Federal Reserve’s shift to expansionary monetary policy. The uncertain economic conditions and Bitcoin’s continued underperformance compared to gold have led traders to remain cautious about risk aversion.

Gold/USD (left) vs. Bitcoin/USD (right). Source: TradingView

Macroeconomic Uncertainty and Bitcoin’s Underperformance

The Fed’s decision to cap interest rates at 3.75% was widely expected, and Fed Chairman Jerome Powell struck a dovish tone during the press conference following the committee meeting. Powell highlighted ongoing risks related to labor market weakness and stubborn inflation. However, two Fed members voted to keep interest rates at 4%, an unusually wide divergence for a committee that typically has a strong internal bias.

The Fed’s announcement that it would begin purchasing short-term government bonds to “help manage liquidity levels” marks a significant turnaround from recent years. The initial $40 billion program approved Wednesday increases the liquidity that banks can lend, supports credit growth, stimulates business investment, and encourages consumer borrowing at a time when economic momentum across the economy is weakening.

Bitcoin Options and the $100,000 Call

The $100,000 BTC call (buy) option implies a 70% probability that Bitcoin will remain at or below $100,000 through January 30, according to the Black & Scholes model.

$100,000 BTC call option on Deribit, USD. Source: laevitas.ch

To secure the right to purchase Bitcoin at a fixed price of $100,000 on January 30, buyers must pay an upfront premium of $3,440. For comparison, the same call option traded at $12,700 just a month earlier. The instrument effectively acts as insurance and expires worthless if Bitcoin trades below the strike price.

Market Sentiment and the Impact of the Fed’s Policy Change

The stock market is directly benefiting from the Federal Reserve’s expansionary stance as companies expect lower costs of capital and easier consumer financing. However, Bitcoin tends to respond less predictably because investors exiting safe-haven short-term treasuries are unlikely to view the cryptocurrency as a reliable store of value.

S&P 500 index (left) vs. five-year US Treasury yield (right). Source: TradingView

The five-year U.S. Treasury yield was at 3.72% on Wednesday, down from 4.1% six months earlier, while the S&P 500 rose 13% over the same period. Traders worry that U.S. government debt growth could weaken the dollar and increase inflationary pressures, making the relative scarcity of stocks more attractive despite concerns about stretched valuations.

Currently, Bitcoin whales and market makers remain extremely skeptical of a sustained rise above $100,000, even if the Fed’s policy change creates more favorable conditions. What could trigger a Bitcoin rally remains uncertain, but the rising cost of artificial intelligence outage protection could prompt traders to reduce their exposure to stocks.

This article is for general information purposes and is not intended to constitute, and should not be construed as, legal, tax, investment, financial or other advice. The views, thoughts and opinions expressed herein are those of the author alone and do not necessarily reflect the views and opinions of Cointelegraph. While we strive to provide accurate and up-to-date information, Cointelegraph does not guarantee the accuracy, completeness or reliability of the information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read more about the Fed’s rate cut and its potential impact on Bitcoin at https://cointelegraph.com/news/fed-rate-cut-qe-could-pump-stocks-but-bitcoin-options-call-sub-100k-in-january?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound