Bitcoin’s Path to $112,000: Four Key Factors to Watch

Bitcoin (BTC) has been trading below $92,000 since Thursday, marking a 22% decline over the past 30 days. However, multiple factors could soon contribute to a reversal of this trend. Bulls anticipate that governments will increase their money supply to support their economies and address rising fiscal deficits, while bears point to softer labor indicators and concerns over artificial intelligence investment trends.

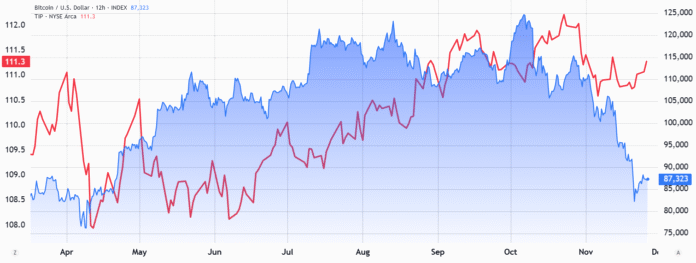

Both perspectives have merit, and the recent short-term weakness could ultimately provide a foundation for a more durable Bitcoin rally. Four key catalysts will determine how quickly the price can retest the $112,000 level last seen four weeks ago. The iShares TIPS Bond ETF, which tracks US Treasury Inflation-Protected Securities, has resumed its upward trajectory after retesting support at 110.50 on Thursday. This ETF typically advances when investors anticipate higher inflation, a backdrop that tends to favor Bitcoin as traders seek alternative hedges.

Bond futures data from the CME FedWatch Tool shows traders assigning a 78% probability that the US Federal Reserve (Fed) maintains interest rates at 3.50% or above through Jan. 26, up from 47% on Oct. 24. Lower rates generally benefit companies reliant on leverage and often stimulate consumer credit demand. The uncertainty stemming from the extended US government funding shutdown, which lasted until Nov. 12, could prompt the Fed to leave rates unchanged in December.

US Federal Reserve’s Role in Bitcoin’s Next Rally

A significant shift is likely in the first half of 2026. US Fed Chair Jerome Powell’s term ends in May, and US President Donald Trump has made clear he prefers a candidate who favors a less restrictive monetary stance. No nomination date has been announced, and the process typically includes several months of Senate hearings and votes. Bloomberg also reported that US regulators have finalized a rule that will lower capital requirements for the largest banks by Jan. 1, 2026.

These developments could serve as catalysts for risk-on assets, including Bitcoin, as the Trump administration has signaled plans to stimulate economic growth through expanded government borrowing. Beyond macroeconomic considerations, two developments within the Bitcoin ecosystem may influence a potential move above $100,000. In October, the MSCI Index said it was consulting investors on whether to exclude companies whose primary focus is accumulating Bitcoin and other digital assets. A final decision is expected on Jan. 15.

Bitcoin Derivatives and Market Sentiment

Bitcoin derivatives have faced persistent pressure over the past four weeks, as reflected in a 10% premium for put (sell) options compared to equivalent call (buy) contracts. Given the scale of the year-end $22.6 billion BTC options expiry on Dec. 26, traders will likely wait for the skew to ease toward a neutral 5% or below before regaining confidence. Overall, a move toward $112,000 remains feasible for Bitcoin, though it appears more likely to materialize during the first half of 2026.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph. For more information, visit the original source: https://cointelegraph.com/news/bitcoin-s-path-back-to-112k-and-higher-depends-on-four-key-factors