Crypto Traders’ Sentiment Splits as Bitcoin Price Fluctuates

Crypto trader sentiment on social media is currently divided, with some predicting Bitcoin to fall below $70,000 and others expecting it to rise to $130,000. This split in sentiment comes as Bitcoin (BTC) fell below $87,000 on Thursday for the first time since April. According to market intelligence platform Santiment, “social volume still shows a mix of buying optimism and doom and gloom, with very little in between.”

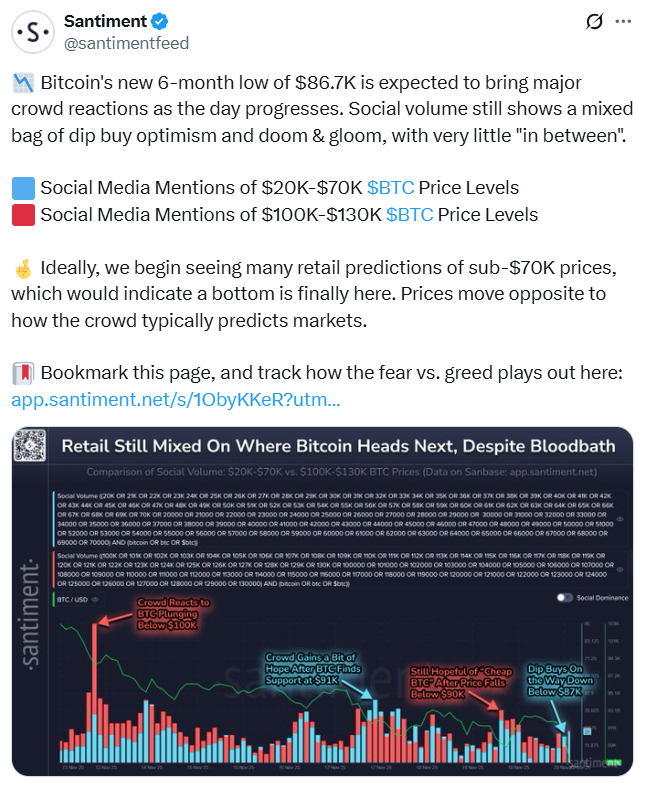

Data from Santiment’s research platform, Sanbase, found that social media mentions on Thursday were roughly evenly split between predictions that Bitcoin would fall to $20,000 to $70,000 and more optimistic predictions of $100,000 to $130,000. However, by Friday, there were further discussions about lower Bitcoin prices.

Source: Santiment. Ideally, we are seeing a lot of retail forecasts for prices below $70,000, which would suggest that a bottom has finally been reached. Prices are moving in the opposite direction to what the crowd typically predicts in the markets.

Tug of War Between Crypto Bulls and Bears

Nic Puckrin, analyst and co-founder of educational portal The Coin Bureau, said in a research note that Bitcoin is being “pulled in different directions by conflicting news” as a “tug-of-war between bulls and bears” unfolds. On the one hand, the chances of an FOMC rate cut in December are rapidly fading – on the other hand, it is a sign of relief that the AI bubble will not implode following Nvidia’s better-than-forecast earnings.

“If this positive sentiment continues into the weekend, Bitcoin is likely to follow suit,” Puckrin said, adding that in the event of an uptrend, the “next resistance level to watch” is around $107,500.

Extreme Fear Presents an Opportunity, but Timing is Everything

Rachael Lucas, an analyst at Australian cryptocurrency exchange BTC Markets, noted that Bitcoin is trading at around $87,000 and technical indicators such as momentum, money flow, and volume are all trending lower, “reflecting a sharp deterioration in sentiment.” The volatility is caused by a combination of macroeconomic pressures, liquidity withdrawal from the market, risk aversion, and the cyclical dynamics that have historically characterized Bitcoin price action.

The Crypto Fear & Greed Index, which measures overall market sentiment, has returned a score of 14, putting it in the “extreme fear” range. However, it is still slightly above Thursday’s value of 11, the lowest since February.

The Fear & Greed Index showed a value of 14 on Friday, which means extreme fear. Source: alternative.me. Lucas said: “Extreme fear often precedes opportunity, but timing is everything.” With technicals under pressure and macroeconomic risks elevated, traders and investors face a challenging environment.

Whether this marks the start of a deeper correction or sets the stage for a recovery will depend on liquidity conditions, regulatory developments, and institutional inflows in the coming weeks. For more information, visit https://cointelegraph.com/news/crypto-traders-bitcoin-sentiment-dip-buy-fear