Bitcoin Reaches New All-Time High, Surpassing $123,000

Bitcoin (BTC) has achieved a new milestone, reaching an all-time high of over $123,231 on Wednesday on Coinbase. This significant surge follows a similar trend seen in the S&P 500, which rallied to a record high of 6,457. The cryptocurrency’s ascent to new heights comes on the heels of the July US CPI print, which showed inflation holding steady at 2.7% year-over-year, unchanged from June and below the forecasted 2.8%.

The data released also indicated that overall CPI increased by 0.2%, compared to a 0.3% increase in June. Following the report’s release, the CME FedWatch tool revealed that the market odds of an interest rate cut at the Federal Reserve’s September meeting rose to 93.9%. Long-time crypto investors believe that Fed rate cuts and a shift away from quantitative tightening are historically beneficial to Bitcoin’s price action.

Impact of Economic Policies on Bitcoin’s Price

Many investors also anticipate that the implementation of US President Donald Trump’s economic agenda, outlined in the One Big Beautiful Bill, will lead to an increase in spending, inflation, and risk-seeking in financial markets. This, in turn, is expected to have a positive impact on Bitcoin’s price. Additionally, inflows to the Bitcoin and Ether spot ETFs have caught traders’ attention, adding to the bullish sentiment present throughout the market.

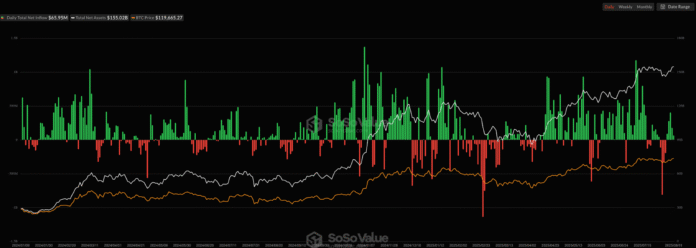

Farside Investors’ X account shows that the BTC ETF net flows reached $65.9 million, while the ETH instrument saw $523.9 million in share purchases on Tuesday. On Tuesday, the ETH ETF saw its first $1 billion inflow, and while the Bitcoin ETF net flows have slowed, the instrument still saw $1.02 billion in inflows since Friday. The cumulative impact of ETH’s success is clearly boosting sentiment across Bitcoin and altcoin prices.

Bitcoin spot ETF netflows. Source: SoSoValue.com

Liquidation heatmap data from Hyblock shows Bitcoin pushing through a short liquidation cluster starting at $122,500, with room for further forced closure of positions extending to $124,000. Data from CoinGlass suggests that nearly $2 billion in short positions are at risk of liquidation if traders push BTC price through the $122,800 to $125,500 liquidity cluster.

Market Cap and Total Crypto Market Cap

Bitcoin’s rally to new highs puts its market cap above $2.45 trillion, while the total crypto market cap currently stands at a record $4.15 trillion. As the cryptocurrency market continues to grow, investors are keeping a close eye on the trends and factors influencing Bitcoin’s price.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin exchange liquidation map (cumulative). Source: CoinGlass

For more information on Bitcoin and the cryptocurrency market, visit the original source.