Bitcoin’s Short-Term Traders Face Steep Unrealized Losses, Sparking Fears of a Make-or-Break Point

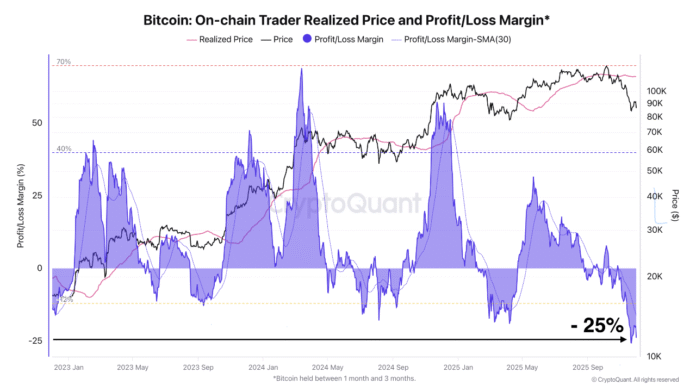

Bitcoin may be nearing a critical juncture as short-term traders grapple with the steepest unrealized losses of the current bull cycle, according to CryptoQuant analyst Darkfrost. Traders who have held Bitcoin (BTC) between one to three months have been sitting on losses ranging from 20% to 25% for over two weeks, marking the highest pain point of the current market cycle.

Darkfrost notes that “once a large portion of them has capitulated, as we have seen in recent weeks, that is usually when the opportunity to accumulate becomes interesting.” This cohort will remain underwater until BTC trades back above its realized price of about $113,692, Darkfrost added. Bitcoin onchain trader realized price and profit/loss margin. Source: CryptoQuant

Optimism from Financial Institutions and ETF Analysts

Despite the current correction, some of the largest financial institutions remain optimistic about Bitcoin’s trajectory in 2026. Asset management giant Grayscale said that Bitcoin’s current drawdown points to a local bottom ahead of a recovery in 2026 — a development that will invalidate the four-year cycle theory, according to the company. On the other hand, ETF analyst Eric Balchunas believes that Bitcoin ETFs have been a minor contributor to the selling pressure behind Bitcoin’s price decline, accounting for only up to 3% of the total selling pressure. Source: Eric Balchunas

Bitcoin ETF Flows Recover, Sparking Hope for a Rebound

Bitcoin ETFs have started to recover from the $3.48 billion of cumulative outflows recorded during November, marking their second-worst month on record. The Bitcoin ETFs recorded $58 million worth of net positive inflows on Tuesday, staging their fifth consecutive day of positive inflows, according to Farside Investors data. Bitcoin ETF Flow USD, million. Source: Farside Investors

Those modest inflows could continue as Bitcoin trades back above the roughly $89,600 flow-weighted cost basis for ETF buyers, meaning the average holder is no longer sitting on paper losses. Looking at the other US crypto funds, spot Ether (ETH) ETFs saw $9.9 million in outflows on Tuesday, while the Solana (SOL) ETFs recorded $13.5 million of net negative outflows, according to Farside Investors.

For more information, visit the original source: https://cointelegraph.com/news/bitcoin-short-term-losses-etf-flows-recover-2026-outlook?utm_source=rss_feed&utm_medium=rss_tag_bitcoin&utm_campaign=rss_partner_inbound