Bitcoin (BTC) has experienced a 3.4% correction over the weekend, driven by rising global socio-political tensions and China’s slowest economic growth since 2022. The sudden retest of $92,000 caught bulls off guard, resulting in the forced liquidation of $215 million worth of leveraged BTC futures long positions. This has fueled concerns that a deeper price correction may be underway.

The retest of $92,000 was unexpected, and the resulting liquidation of leveraged positions has raised questions about the sustainability of the current price level. Despite quickly reclaiming the $93,000 mark, the broader market continues to view cryptocurrencies as risky assets rather than alternative hedges. Investors have been seeking safety in cash positions and precious metals, with gold prices rising above $4,650 for the first time.

Weak BTC derivatives indicate waning interest and hedging appeal

The annual premium of Bitcoin futures has hovered near the neutral to bearish level of 5%, suggesting that demand for leveraged bullish positions was not affected by the failed attempt to reclaim $98,000. However, the lack of enthusiasm in BTC derivatives markets could indicate waning interest from institutional investors. Bitcoin spot exchange-traded funds (ETFs) recorded $395 million in net outflows on Friday, further weighing on trader sentiment.

As gold and silver prices reach all-time highs, Bitcoin’s appeal as a hedging instrument appears less compelling. In response, professional traders have demanded higher premiums to protect themselves from losses. The delta skew of BTC options on Deribit rose to 8%, suggesting that put (sell) options are trading at a premium. This indicates a reduction in whales’ confidence in a bullish breakout above $100,000.

Macroeconomic factors influence trader risk appetite

George Saravelos, head of foreign exchange research at Deutsche Bank, noted that European countries own $8 trillion worth of U.S. bonds and stocks, almost twice as much as the rest of the world combined. The U.S. fiscal imbalance depends on continued capital inflows, and if the “Western alliance” is fundamentally disrupted, Europe may no longer be “as willing” to support the US dollar. China’s economy grew 4.5% year-on-year in the final quarter of 2025, compared with 4.8% in the previous quarter, with strong exports helping to offset weaker consumer spending and business investment.

Analysts warn that consumer stimulus measures introduced in 2025 could be scaled back, while a global trade war could weigh on exports. The combination of these macroeconomic factors has led to a decline in Bitcoin network activity, with the number of daily active addresses falling to 370,800, a decline of 13% from two weeks earlier. Healthy blockchain demand is essential to supporting mining investments, and the current decline in activity is a concern for the sustainability of the network.

US Bitcoin traders react pessimistically – is BTC price at risk of losing $90,000?

The weakness in BTC derivatives metrics and the decline in network activity have led to concerns that the $92,000 level may not be sustained. Investors remain wary of a global economic slowdown and the impact of the Trump administration’s goals, including the potential acquisition of Greenland. The current market conditions have resulted in a decline in trader confidence, with many seeking safety in traditional assets such as gold and silver.

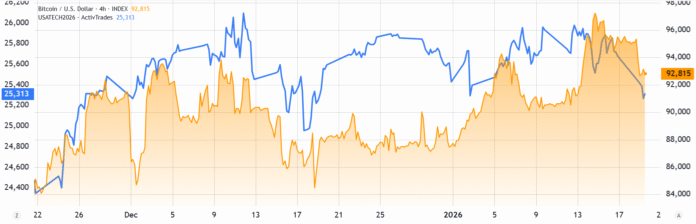

Nasdaq index futures (left) vs. Bitcoin/USD (right). Source: TradingView

Nasdaq index futures (left) vs. Bitcoin/USD (right). Source: TradingView

Base interest rate for Bitcoin futures. Source: laevitas.ch

Base interest rate for Bitcoin futures. Source: laevitas.ch

BTC 30 Day Options Delta Skew (Put Call) at Deribit. Source: laevitas.ch

BTC 30 Day Options Delta Skew (Put Call) at Deribit. Source: laevitas.ch

Daily active addresses of the Bitcoin network. Source: Nansen

Daily active addresses of the Bitcoin network. Source: Nansen

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information, visit https://cointelegraph.com/news/bitcoin-shows-strength-at-92k-but-is-the-bottom-in?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound