Bitcoin Price Analysis: Understanding the Current Market Trend

Bitcoin (BTC) has been experiencing a significant pullback, with its price dropping below the previous all-time highs of $109,300. This has left crypto traders and investors wondering where the BTC price will head next. The current market trend is crucial in understanding the potential future price movements of Bitcoin.

Crypto traders are closely watching the BTC price, with some predicting a further decline. The bulls are currently nursing a 13% pullback from the all-time highs, which has raised concerns about the potential for a deeper correction. The psychological level of $109,300 now hangs in the balance, and it is not the only nearby level that observers are concerned about.

Key Trendlines and Moving Averages

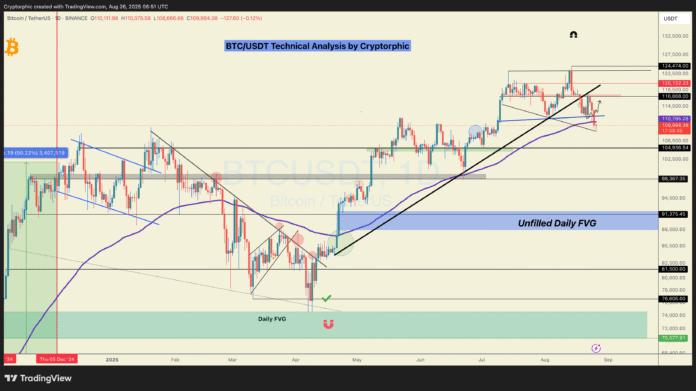

Bitcoin’s latest dive took the BTC/USD price below the previous all-time highs first seen in January 2025. Various simple (SMA) and exponential (EMA) moving averages risk getting flipped from support to resistance as the price struggles to halt its decline. Popular trader Cryptorphic warned in an X post on Tuesday that “BTC has broken below the 100 EMA on the daily chart. That’s not a good sign and could open the door for a deeper correction toward $103K.”

Historically, every drop below this EMA has led to a short-term pullback. The 100-day EMA is currently at $110,820, according to data from Cointelegraph Markets Pro and TradingView. The 200-day SMA, meanwhile, sits lower at just under $101,000, which is a classic bull market support line. The last time that BTC/USD traded below that trend line was in mid-April.

BTC/USDT one-day chart. Source: Cryptorphic/X

BTC/USD one-hour chart with 100-EMA, 200-day SMA. Source: Cointelegraph/TradingView

Speculators and BTC Price Targets

Some market participants have much lower BTC price targets in mind, including a retest of the $100,000 mark and even a drop back into five-figure territory. This is thanks to a combination of weakening on-chain metrics such as trade volume and relative strength index (RSI) divergences.

BTC/USD four-hour chart with RSI divergence. Source: Cointelegraph/TradingView

For Axel Adler Jr., a contributor to on-chain analytics platform CryptoQuant, Bitcoin’s speculative investor base may be what saves the market. “The nearest strong support zone is the 100K–107K range, where the STH Realized Price and SMA 200D intersect,” he noted on Tuesday.

BTC/USD chart with 200-day SMA, STH cost basis. Source: Axel Adler Jr./X

Short Squeeze and Potential Price Movement

Bitcoin has sparked several major liquidation cascades in recent days as long positions get punished. Data from CoinGlass puts total BTC long liquidations at nearly $500 million since Sunday.

BTC total liquidations (screenshot). Source: CoinGlass

Exchange order books reveal that the majority of liquidity to the downside has been taken, leading to faint hopes of a market rebound. “I think $BTC will hit $114K-$115K this week, leading to a nice rally in alts,” trader BitBull predicted in an X post on Tuesday.

BTC liquidation heatmap. Source: CoinGlass

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. For more information, visit the original source link: https://cointelegraph.com/news/bitcoin-drops-under-109k-how-low-can-btc-price-go-next?utm_source=rss_feed&utm_medium=rss_tag_bitcoin&utm_campaign=rss_partner_inbound