Bitcoin Price Sees Glimmer of Hope as US Federal Reserve Rate Cut Odds Surge

Bitcoiners were noticeably more upbeat on social media today as the odds of a US Federal Reserve rate cut in December nearly doubled compared to just a day earlier. The sudden shift in sentiment has sparked speculation that this could be the catalyst Bitcoin (BTC) needs to halt the asset’s downward trend. According to CoinMarketCap, Bitcoin’s price trades at $85,071, down 10.11% over the past seven days.

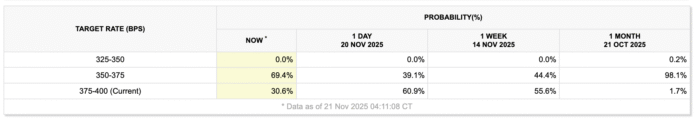

Crypto analyst Moritz said in an X post on Friday, “Let’s see if that’s enough to find a bottom here for now.” The odds of an interest rate cut at the December Federal Open Market Committee (FOMC) meeting almost doubled to 69.40%, according to the CME FedWatch Tool. Just the day before, on Thursday, it was nearly 30.30% lower, at 39.10%. The odds of a US Federal Reserve rate cut jumped 30.30% on Friday. Source: CME Group

Market Reaction and Analyst Insights

Many in the wider market attributed the spike at least partly to dovish remarks from New York Fed president John Williams, who said the Fed can cut rates “in the near term” without endangering its inflation goal. Bloomberg analyst Joe Weisenthal said it was the reason the odds have “massively increased.” However, economist Mohamed El-Erian warned market participants not to get “carried away” by the comments.

Crypto analyst Jesse Eckel pointed to the surging rate cut odds and said, “If you zoom out, the setup is unfathomably bullish.” “I don’t know why we keep going lower,” Eckel said. “We are going from a tightening cycle into an easing cycle,” he added. Source: Ted

Crypto Market Sentiment and Rate Cut Odds

Coinbase Institutional said in a X post on Friday, “While markets are leaning toward ‘no cut’ this time, we believe the odds for a rate cut are actually mispriced. Recent tariff research, private market data, and real-time inflation indicators suggest otherwise.” The Crypto Fear & Greed Index, which measures overall crypto market sentiment, posted an “Extreme Fear” score of 14 in its Friday update.

For more information, read the original article on Cointelegraph.