Bitcoin Price Rebound Expected as RSI Falls to Lowest Level in Almost Three Years

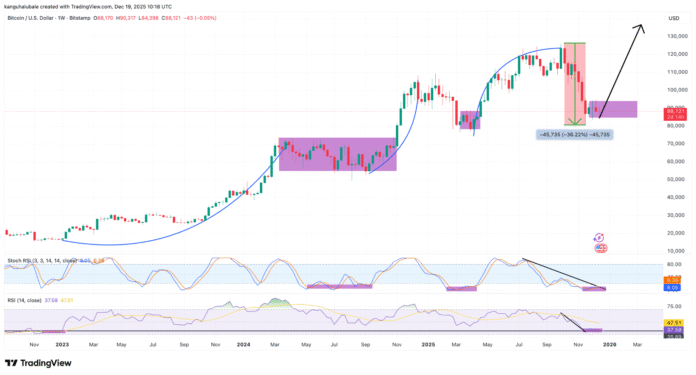

Bitcoin (BTC) traders are anticipating a short-term rebound as a key BTC price metric has fallen to its lowest level in almost three years. Data from Cointelegraph Markets Pro and TradingView showed extremely “oversold” conditions on the BTC/USD Relative Strength Index (RSI). This development has sparked hopes of a near-term price reversal, with some analysts suggesting that the cryptocurrency may be due for a significant rally.

The RSI measures trend strength and contains three key levels for observers: the 30 oversold limit, the 50 midpoint, and the 70 overbought threshold. When the price breaks above these levels, traders can draw conclusions about the future of a particular up or down trend depending on the direction. During bull markets, ETH regularly spends extended periods in overbought territory. The current RSI reading has fallen to 35, a level last seen in January 2023 when Bitcoin was trading at around $15,500 to $17,000.

Historical Precedent for Price Reversal

Analyst Jelle noted in an X post that “historically, when the weekly RSI marks this level, it is time to pay attention,” adding that “either we’re close to rock bottom, or we’re about to experience a lot more pain.” Mister Crypto also commented that “Bitcoin appears to be more oversold than ever before,” suggesting that “an upswing is very likely.” The BTC/USD weekly chart shows the RSI falling from local highs of 64 in September to 35 at the time of writing.

BTC/USD weekly chart. Source: Cointelegraph/TradingView

BTC/USD weekly chart. Source: Cointelegraph/TradingView

On-Chain Data Suggests Undervaluation

On-chain data provider CryptoQuant has explained how Bitcoin may currently be undervalued based on its network value for transactions (NVT), a metric that compares market capitalization to its actual network usage. The chart below shows that Bitcoin’s NVT Golden Cross has fallen to historically low levels near -0.6, “an area that reflects structural undervaluation of the network,” CryptoQuant analyst MorenoDV_ said in his latest Quicktake analysis.

Bitcoin: NVT golden cross. Source: CryptoQuant

Bitcoin: NVT golden cross. Source: CryptoQuant

The metric has risen slightly to -0.32 in recent days, indicating that the price is gradually aligning with transactional fundamentals after a steep valuation discount. However, “the indicator remains in negative territory, meaning Bitcoin’s price is still conservative relative to its network utility,” the analyst said, adding that “the current situation suggests a market transition from severe undervaluation to equilibrium, a phase historically associated with accumulation and structurally sounder price discovery.”

Expert Insights and Market Expectations

Not all traders are quick to suggest that BTC price will see a recovery bounce due to oversold conditions. YouTuber Lark Davis noted that “when $BTC was so oversold in 2018, it fell another 49%. In 2022, it fell another 58%,” suggesting that Bitcoin could fall another 40%. However, other analysts remain optimistic, with CryptosRus responding to MorenoDV_’s analysis that “the price is recovering now, but the valuation is still discounted compared to usage,” adding that “this setup has only appeared a few times in Bitcoin’s history.”

BTC/USD two-week chart. Source: Mister Crypto

BTC/USD two-week chart. Source: Mister Crypto

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. While we strive to provide accurate and up-to-date information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of the information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information. For more information, visit https://cointelegraph.com/news/bitcoin-weekly-rsi-falls-to-the-most-oversold-levels-since-15k-btc-price