Bitcoin’s Next Super Rally: Understanding the Impact of Long-Term Holder Distribution

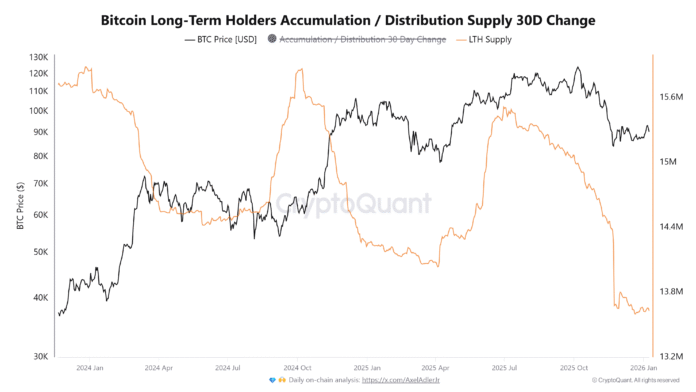

Bitcoin’s long-term holders (LTHs) experienced one of the most aggressive distribution phases on record in 2025, with approximately $300 billion in BTC being distributed. This significant supply reset has raised questions about its potential impact on the market and whether it could be a precursor to the next bullish period for BTC price.

The distribution of Bitcoin by long-term holders is a critical metric, as it can indicate a shift in market sentiment and potential trend reversals. Historically, heavy LTH selling has occurred near cycle peaks or during structural transitions, rather than at the start of new downtrends. This suggests that the recent selling pressure may be a sign of a market reset rather than a continuation of a downward trend.

A Historic Unwind: Bitcoin’s 2025 Volatility

The amount of Bitcoin that had remained unmoved for at least two years moved sharply on-chain in 2025, with nearly $300 billion worth of Bitcoin re-entering circulation. The 30-day period between November 15 and December 14, 2025, marked one of the heaviest long-term holder distribution periods in more than five years.

Since 2019, sharp declines in long-term holder supply have rarely appeared in isolation, instead surfacing during phases when Bitcoin’s trend was already under strain. This pattern suggests that LTH distribution can precede recovery rather than mark its end. For example, in 2018, the LTH supply fell from 13 million BTC to 12 million BTC, with selling intensity peaking when the 30-day distribution reached 1.08 million BTC in December.

Historical Context: Long-Term Holder Distribution and Market Trends

The 2020-2021 cycle unfolded differently, with LTH supply dropping from 13.7 million BTC to 11.65 million BTC, while Bitcoin climbed from $14,000 to $61,000. The 30-day distribution peak of 891,000 BTC did not immediately halt the rally, instead, selling persisted as prices rose, gradually eroding upside momentum before the cycle ultimately rolled over.

During the 2024-2025 bull run, supply declined from 15.8 million BTC to 14.5 million BTC, with the 30-day distribution peaking at 758,000 BTC. Price topped slightly earlier in March, and both metrics then moved sideways through Q2-Q3, reinforcing a familiar pattern: price strength tends to fade as long-term holders step up distribution.

What the Pause in Selling May be Signaling

Since December, the LTH supply has stopped falling, currently around $13.6 million, while Bitcoin has entered a sideways range. Additional confirmation comes from the long-term/short-term holder supply ratio, which has historically marked transition phases rather than trend continuation. Every time this ratio has fallen to -0.5 or below, Bitcoin has either entered a base-building phase or rallied to new highs within weeks.

Thus, this combination of aggressive distribution followed by supply stabilization has historically marked transition phases rather than trend continuation. If the trend repeats, the consolidation through Q1-Q2 could act as a base-building period, with any sustained rally more likely to emerge later, potentially into Q3.

For more information, read the original article on Cointelegraph.