Bitcoin’s Road to Recovery: Analysts Weigh In on the Cryptocurrency’s Future

Bitcoin’s recent correction has sparked a mix of predictions from analysts, with some forecasting a slower path to new highs and others expecting a more rapid recovery. According to network economist Timothy Peterson, the current decline is consistent with Bitcoin’s historical recovery patterns, with the average recovery to a new all-time high (ATH) from these levels taking 2-6 months.

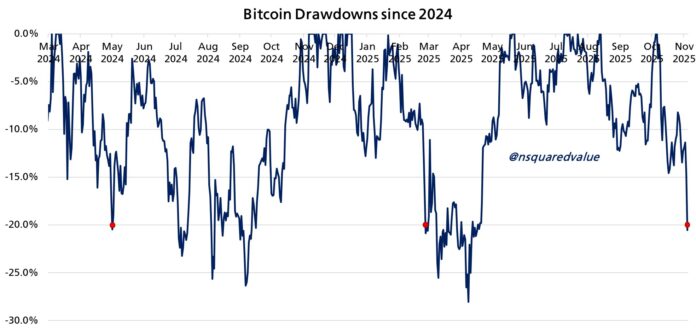

Since reaching an all-time high of $126,200 on October 6, Bitcoin (BTC) has fallen about 20% and is currently hovering below the $100,000 mark. Peterson explained that this decline is the third 20% decline from an all-time high since 2024, and simulations created by AI suggest that the probability of Bitcoin reaching $140,000 by the end of the year is less than 20%. The probability of Bitcoin ending above $108,000 is 50%, and the probability of ending 2025 in the red is 30%.

Galaxy head of research Alex Thorn has also lowered the company’s year-end BTC target from $185,000 to $120,000, citing market maturity. Thorn noted that Bitcoin is entering a phase where institutional participation, passive inflows, and reduced volatility are driving price behavior. Thorn added that holding $100,000 support could keep the three-year uptrend structurally intact, but that “future gains could unfold more slowly and steadily as Bitcoin enters an era of maturity.”

Mixed Outlooks and Predictions

Crypto trader Titan of Crypto offered a more mixed outlook, predicting a potential new all-time high near $130,000 by year-end, but warning that Bitcoin could fall below $70,000 by the first quarter of 2026 based on a Wyckoff distribution analysis.

Despite the widespread caution, Bitcoin commentator Shanaka Anslem Perera took a contrary view, arguing that the recent correction could actually be setting BTC up for a parabolic phase. Perera said 29.2% of Bitcoin supply is now underwater, a level that has preceded major upswings in the past. Perera noted that similar metrics emerged before the 2017, 2021, and 2024 bull runs, each resulting in a 150% to 400% increase within six months.

The Market Reset for Bitcoin’s Next Phase

According to Perera, leverage in the derivatives markets has been depleted, while long-term holders now control about 70% of the supply. Institutional accumulation through ETFs and rising stablecoin reserves suggest “liquidity is recharging beneath the surface.” The analyst concluded that Bitcoin’s current structure, unless triggered by a major macroeconomic or geopolitical shock, reflects pre-breakout conditions, with the next 180 days potentially marking the start of another explosive cycle.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information, visit https://cointelegraph.com/news/new-bitcoin-highs-could-take-2-to-6-months-but-data-says-it-s-worth-the-wait-analysis?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound