Bitnomial Receives CFTC Approval to Launch Prediction Markets

Bitnomial Clearinghouse LLC has obtained approval from the US Commodity Futures Trading Commission (CFTC) to process fully collateralized swaps, enabling its parent company Bitnomial to introduce prediction markets and offer clearing services to other platforms. This development marks a significant expansion of Bitnomial’s trading product offerings, which already include perpetuals, futures, options contracts, and leveraged spot trading on its Chicago-based exchange and clearing divisions.

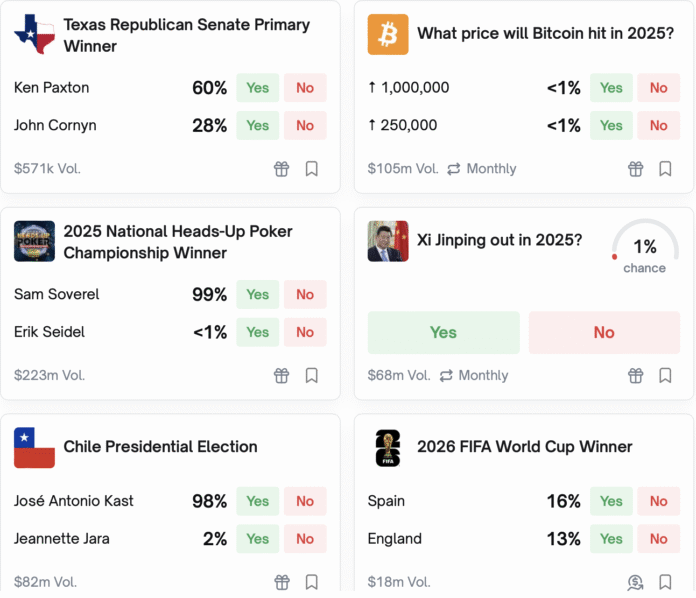

According to the announcement, Bitnomial’s prediction market will cover a range of events, including crypto and economic outcomes, in addition to its existing Bitcoin (BTC) and crypto derivatives products. The contracts are designed to allow traders to take positions on various outcomes, such as token price levels and macroeconomic data. This move is expected to strengthen the entire prediction market ecosystem, as stated by Bitnomial President Michael Dunn, who emphasized the company’s ability to serve both its own exchange and external partners.

Bitnomial Clearinghouse operates as a pure infrastructure clearing provider, providing approved partners with access to its margin and settlement systems. This enables collateral conversion between US dollars and cryptocurrency, facilitating a more seamless trading experience. The approval comes on the heels of the company’s recent green light to launch a CFTC-regulated cryptocurrency spot trading platform in the US, allowing customers to buy, sell, and trade leveraged and non-leveraged crypto products on a government-regulated exchange.

Event contracts on Polymarket. Source: Polymarket

Prediction Markets Gain Momentum in the US

Prediction markets have become a significant trend in 2025, with platforms like Kalshi and Polymarket gaining traction. According to data from DefiLlama, Kalshi generated $5.27 billion in trading volume over the past 30 days, while Polymarket recorded just under $2 billion in the same period. This growth is expected to continue, with Polymarket recently receiving regulatory approval from the CFTC to operate an intermediary trading platform that allows access through registered brokers under rules applicable to US markets.

Kalshi trading volume. Source: DefiLlama

Polymarket has also struck several partnerships in recent months, including with UFC and Zuffa boxing and fantasy sports provider PrizePicks in November. The platform settles contracts on the Polygon blockchain using the USDC (USDC) stablecoin. With the growing adoption of prediction markets, it will be interesting to see how this space evolves in the coming months.

For more information, visit https://cointelegraph.com/news/bitnomial-cftc-approval-launch-prediction-markets?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound