Blackrock Explores Tokenized ETFs After Successful Bitcoin Funds

Blackrock, the world’s largest asset manager, is reportedly considering tokenizing its exchange-traded funds (ETFs) on the blockchain, following the strong performance of its spot bitcoin ETFs. According to Bloomberg, the company is discussing the possibility of tokenizing money market funds with exposure to real-world assets (RWA), although this would require navigating regulatory hurdles.

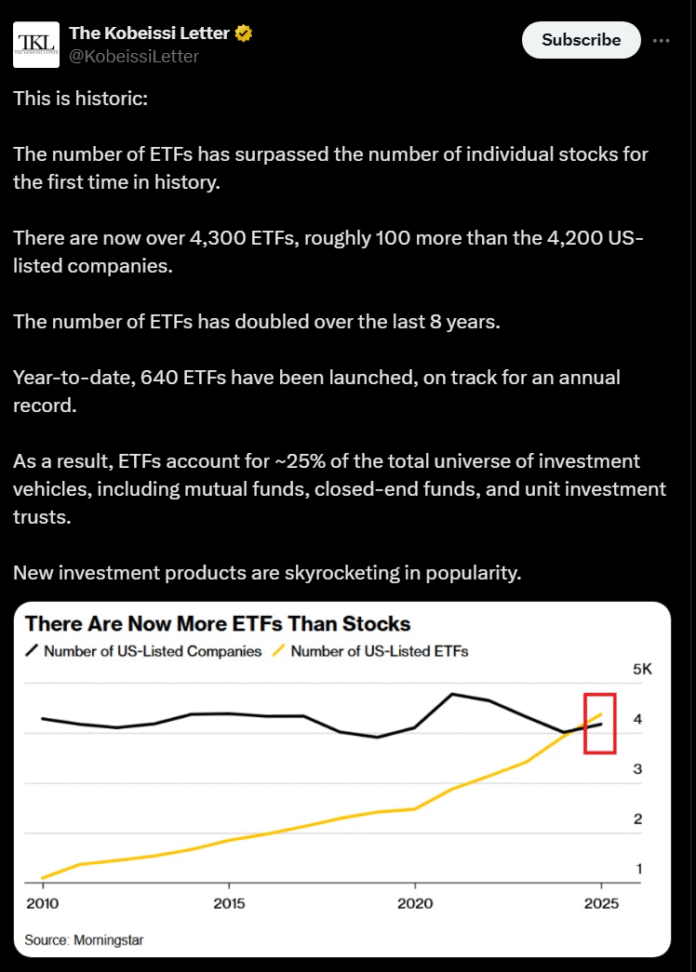

ETFs have become a popular investment vehicle, with Morningstar reporting that they are now as widespread as publicly listed stocks. Tokenized ETFs could offer additional benefits, such as enabling trading beyond standard market hours and serving as collateral in decentralized finance (DeFi) applications.

Source: The Koobeissi letter

Blackrock’s interest in tokenization is not new, as it already manages the world’s largest tokenized money market fund, the Blackrock USD Institutional Digital Liquidity Fund (Buidl), with $2.2 billion in assets across Ethereum, Avalanche, Aptos, Polygon, and other blockchains. JPMorgan has referred to tokenization as a “significant leap” for the $7 billion money market fund industry, with initiatives from Goldman Sachs and Bank of New York Mellon (BNY) also underway.

As part of this initiative, BNY customers have access to money market funds, with the stock company registered directly on Goldman Sachs’ private blockchain. This development is seen as a significant step towards increasing the dominance of traditional finance (TradFi) in the money market fund space.

Buidl market capitalization according to network. Source: rwa.xyz

TradFi’s Push into Blockchain-Based Money Market Funds

The growth of money market funds on blockchain does not occur in a vacuum, but rather alongside increasing pressure on traditional finance, particularly due to the rapid introduction of stablecoins and the shift in liquidity to blockchain-based markets. In May, CoinTelegraph reported that the US banking lobby was cautious about concerns regarding state costs, with tokens from the US Genius law excluded from the first comprehensive legislation on stablecoins.

Source: Ayyyeandy

In June, JPMorgan strategist Teresa Ho stated that tokenized money market funds will likely always attract capital for the industry while improving their attractiveness as collateral. This could help preserve “cash as an asset” in the face of growing stablecoin influence. Ho told Bloomberg, “Instead of posting cash or posting prosecutors, they can post money market tactics and not lose interest on the way. It speaks to the versatility of money funds.”

However, analysts believe that the growth of stablecoins under Genius ultimately benefits tokenization by providing clearer rules and stronger on-ramps in blockchain markets. For more information, read the full article on Cointelegraph.