Block Inc. Shares Plummet After Q3 Earnings Miss Analyst Estimates

Shares in Jack Dorsey’s Block Inc. experienced a significant decline of almost 12% in after-hours trading on Thursday, following the release of its third-quarter earnings report, which fell short of analyst expectations. The crypto-friendly fintech firm reported an earnings per share of 54 cents for Q3, missing the predicted 63 cents by 14%. Additionally, its Q3 revenues of $6.11 billion, although up 2.3% year-on-year, failed to meet the anticipated $6.33 billion.

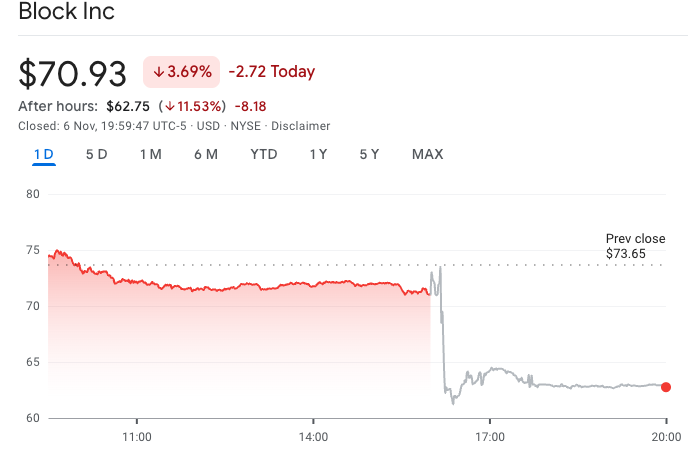

The company’s stock price continued its downward trend, with shares falling 11.53% in after-hours trading to $70.93, after closing the trading day down 3.7% at $62.75. This decline contributes to Block’s overall stock price slide, which has seen shares fall 18.24% so far over 2025. Block’s share price fell after the bell, continuing its slide during Thursday’s trading session. Source: Google Finance

Strong Growth Metrics Amidst Disappointing Earnings

Despite the sharp reaction in the markets, certain metrics from Block’s Q3 results showed strong growth for the company. The firm posted an 18% year-over-year increase in gross profit at $2.66 billion and expects profits to hit $10.24 billion for 2025, representing a 15% yearly increase. Block’s peer-to-peer payments arm, Cash App, generated the majority of its profit with $1.62 billion, marking a 24% yearly increase, while Square, Block’s merchant payments business, accounted for $1.018 billion, a 9% increase.

In terms of overall profit after accounting for operating expenses, Block’s operating income totaled $409 million, up 26% year-over-year. For more information on the current market trends, read about how Bitcoin and stocks are performing.

Block’s Bitcoin Mining Ventures Show Promise

Block’s chief financial officer, Amrita Ahuja, highlighted the progress of the firm’s Bitcoin mining arm, Proto, during an investor call. Ahuja stated that Proto had started to generate revenue, marking the beginning of what could become a significant ecosystem for the company. “We generated our first revenue, seeding what has the potential to become our next major ecosystem,” Ahuja said. “We monetized Proto’s innovation in hardware and software through hardware sales across ASICs, mining hashboards, and full mining rigs that provide many of the key advanced components to mine Bitcoin.”

Proto, launched in November 2024, announced its first mining rig placements in August. Although Q3 revenue was described as “modest,” the company is “actively pursuing a robust pipeline for 2026.” For an in-depth look at innovative uses of Bitcoin, read about one individual’s experience with Bitcoin mortgages.

For the full details on Block Inc.’s Q3 earnings and its implications, visit the original source.