Connect Our Telegram channel to stick as much as pace on breaking information protection

Over the era 24 hours, the cryptocurrency marketplace has obvious numerous actions, with roughly 10% of indexed cryptocurrencies showing sure developments. ConstitutionDAO skilled the most important upturn, marking a acquire of 38.30% inside of this time-frame. Inspecting efficiency over the endmost month, Injective is the important performer, demonstrating an noteceable acquire of two,781.31%.

Greatest Crypto Gainers Nowadays – Supremacy Record

On reflection, Bitcoin’s efficiency in 2023 marked impressive developments pushed through numerous components. The predicted benevolence of a place Bitcoin exchange-traded investmrent (ETF) and the emergence of leading edge packages akin to Ordinals, a Bitcoin-based iteration of non-fungible tokens (NFTs), contributed considerably to its upward trajectory.

1. Bitcoin SV (BSV)

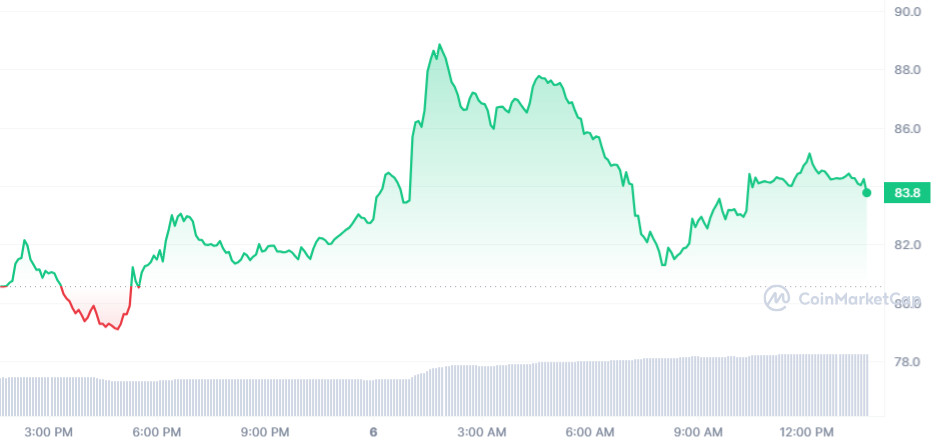

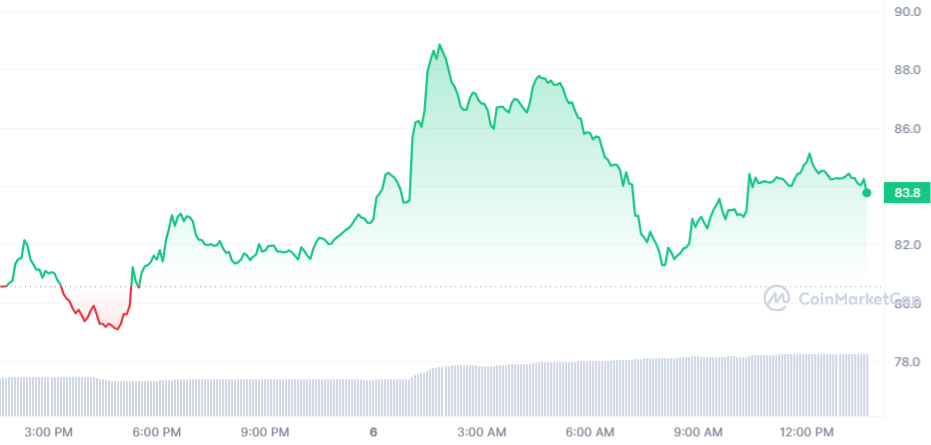

Bitcoin SV marks every other access into the lead crypto gainers as of late. The coin is valued at $83.84, with a buying and selling quantity of $163.82 million over the endmost 24 hours. Its marketplace cap is $1.64 billion, representing a nil.10% marketplace dominance. Over the era era, the fee has obvious a three.79% build up.

Terminating month, the availability inflation charge used to be 1.90%, developing 364,726 BSV. Inside the Layer 1 sector, Bitcoin SV holds the twenty seventh place in response to marketplace cap. Analyzing its efficiency over the era month, BSV has proven a vital build up of 98% in worth.

It has outpaced 59% of the lead 100 crypto belongings right through this era and is at the moment buying and selling above the 200-day easy transferring reasonable. Moreover, it boasts top liquidity because of its considerable marketplace cap. Recently, the sentiment environment Bitcoin SV’s worth prediction is bullish. The Concern & Greed Index registers at 70, indicating a sentiment of “Greed.”

2. Synthetix (SNX)

Synthetix hits the lead crypto gainers as of late with a $3.47 worth and a 2.40% intraday build up. This marks a considerable surge from its rock bottom of $0.032478 recorded on January 5, 2019, but particularly not up to its height of $28.63 on February 14, 2021. The token has skilled fluctuations between its cycle top of $4.94 and a cycle low of $1.400150 since its ATH.

Moreover, the token has constantly traded above its 200-day easy transferring reasonable, signifying a sustained sure pattern. Moreover, it has obvious 15 inexperienced days out of the endmost 30, amounting to a 50% sure efficiency ratio.

Synthetix’s Andromeda Shed: Embracing Buyback and Burn

With the Andromeda Shed on @base, 40% of Perps V3 charges might be allotted to shopping for again and burning $SNX tokens the use of @yearnfi-inspired words.

This technique is designed to successfully distribute charges in… pic.twitter.com/KAQCc4er60

— Synthetix ⚔️ (@synthetix_io) January 5, 2024

Synthetix’s flow marketplace cap is $398.44M, indicating a top degree of liquidity inside of its sector. 114.84M SNX tokens are circulating out of a most provide of 212.42M SNX. As in keeping with its marketplace dominance, Synthetix holds 0.02% of the full marketplace. The sentiment environment Synthetix’s worth prediction is bearish, contrasting with a Concern & Greed Index showing 70 (Greed). This means combined expectancies throughout the marketplace relating to its occasion trajectory.

3. Bitcoin Money (BCH)

BCH makes every other access into the lead crypto gainers as of late with an intraday buying and selling quantity of $510.27M. Over the era 24 hours, BCH has obvious a tiny 0.24% build up in worth. Additionally, sentiment research suggests a bearish outlook for Bitcoin Money, juxtaposed in opposition to a Concern & Greed Index appearing 70 (Greed).

Inside the Evidence-of-Paintings Cash sector, it holds the #4 place in marketplace cap. Additionally, it secures the lead rank throughout the Bitcoin Money sector and ranks #14 within the Layer 1 sector.

Moreover, the token’s highlights come with BCH’s 138% worth build up over the endmost month. As such, it outperformed 68% of the lead 100 crypto belongings inside of the similar length. Likewise, BCH is buying and selling above its 200-day easy transferring reasonable, indicating a favorable pattern. Moreover, throughout the endmost 30 days, BCH has obvious 15 inexperienced days, accounting for fifty% of the seen length. Its top liquidity is evidenced through its marketplace cap.

4. Sponge V2 ($SPONGE V2)

Sponge V2, presented with an preliminary valuation of $1 million, has displayed vital enlargement developments since its inception. Its marketplace capitalization soared to over $100 million in 2023 however at the moment stands at $16 million. This enlargement has attracted a population of greater than 11,500 holders.

🚀 Neglected Sponge V1’s 100x Good fortune?

With a fair higher marketing campaign for #SpongeV2, we’re coming again more potent than ever! 💪

Speed and stake your $SPONGE tokens as of late! 🔥$SPONGE #Crypto #CryptoStaking pic.twitter.com/QIo0RMz4LT

— $SPONGE (@spongeoneth) January 6, 2024

Additionally, Sponge V2 introduces the Stake-to-Bridge style, designed to facilitate a clean transition for $SPONGE holders to V2. This style incentivizes and keeps present holders thru staking mechanisms. Therefore, it deals an strategy to enticing and keeping up person participation right through the migration.

Moreover, the challenge roadmap outlines intentions for number one change listings and has collected aid from a population of 30,000 individuals. Those plans point out a strategic positioning for attainable enlargement, hanging it a number of the lead crypto gainers as of late. As well as, it has attracted hobby from attainable buyers.

5. Stellar (XLM)

Stellar has obvious a impressive worth surge, expanding through 65% over the era month. XLM’s worth is $0.119243, with a marketplace cap of $3.37 billion and a buying and selling quantity of $138.75 million within the endmost 24 hours. Additionally, Stellar is displaying considerable liquidity, as its marketplace cap signifies.

In fresh efficiency, the asset has proven power through constantly buying and selling above its 200-day easy transferring reasonable. As well as, it registered 15 sure buying and selling days within the endmost future, representing a 50% sure pattern charge. Inspecting sentiment signs, flow predictions for Stellar’s worth seem bearish. In the meantime, the Concern & Greed Index, which signifies a degree of 70, indicates greed available in the market sentiment.

For Stellar Population Charity #20, over $1M in XLM used to be awarded to 31 members.

Congrats to everybody and thank you for enjoying a key position in construction out the Stellar ecosystem!

In finding the total recap right here: https://t.co/BIfFD5WMpC

— Soroban (@SorobanOfficial) January 3, 2024

Provide dynamics also are significance attention, as Stellar’s circulating provide is at 28.29 billion out of a most provide of fifty billion. With a annually provide inflation charge of 10.08%, roughly 2.59 billion XLM have been newly minted over the endmost month.

6. Memecoin (MEME)

Memecoin is recently priced at $0.025176, boasting a 24-hour buying and selling quantity of $57.14 million and a marketplace cap of $221.48 million. With a marketplace dominance of 0.01%, it’s the sixth-largest memetic coin within the sector. Over the era era, the MEME worth exhibited a 2.45% build up.

The coin’s historical past displays a height of $0.047306 on December 6, 2023. On the other hand, post-ATH, its lowest worth used to be famous at $0.018240 (cycle low), with the perfect worth since after attaining $0.031205 (cycle top).

Marketplace sentiment predicts a bearish trajectory for Memecoin, by contrast to the Concern & Greed Index, which depicts a degree of 70 (Greed). With regards to its tokenomics, Memecoin has a circulating provide of 8.80 billion MEME out of a most provide of 69.00 billion MEME. This indicates its top liquidity relative to its marketplace cap, hanging MEME amongst as of late’s lead crypto gainers.

7. Ontology (ONT)

Ontology’s flow worth is $0.261871, displaying a 1.56% build up within the era 24 hours. The coin boasts a buying and selling quantity of $66.38 million, conserving a marketplace cap of $229.20 million and a marginal marketplace dominance of 0.01%.

Ontology holds the twenty third rank within the Evidence-of-Stake Cash sector and sits on the 67th place within the Layer 1 sector in response to marketplace cap. Important facets come with a 69% worth surge within the era month, constant buying and selling above the 200-day easy transferring reasonable, and 17 sure buying and selling days out of the endmost 30, accounting for 57%.

🔹 Ontology #EVM Upholder: For those who’re proudly conserving a minimum of 6 $ONG on #Ontology EVM, a Dependable #NFT Plus is yours to assert!

Display your aid for the ecosystem and be rewarded. 🚀

— Ontology #BUIDL4Web3 (@OntologyNetwork) January 5, 2024

Moreover, Ontology’s worth prediction left-overs impartial, aligning with a Concern & Greed Index of 70, leaning in opposition to ‘Greed.’ Additionally, 875.25 million ONT cash are circulated from a most provide of one.00 billion.

Learn Extra

Unutilized Crypto Mining Platform – Bitcoin Minetrix

- Audited Through Coinsult

- Decentralized, Reserve Cloud Mining

- Earn Sovereign Bitcoin Day by day

- Local Token On Presale Now – BTCMTX

- Staking Rewards – Over 100% APY

Connect Our Telegram channel to stick as much as pace on breaking information protection