Bitcoin Price Prediction: BTC Faces $115K Resistance Amid Institutional and Whale Activity

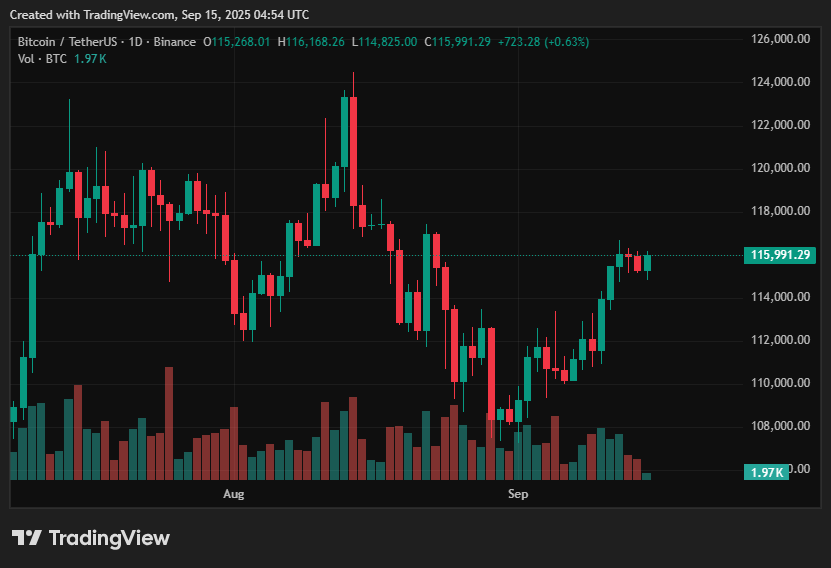

Bitcoin has been trading in a narrow range, fluctuating between $114,000 and $116,000, as fresh data shows that institutional demand is rising and whales are making big purchases again. This development has led market watchers to view the current price action as a possible turning point. According to many online Bitcoin price predictions, technicals, inflows, and macro indications, the asset can experience a significant breakout in the upcoming weeks, which might influence how the macro price action develops through Q4 2025.

The price of Bitcoin has lately broken above $114,000 and is currently holding close to this level while resistance creeps up between $116,000 and $117,500, aligning with the BTC price forecast. Institutional investor demand is rising, according to on-chain indicators, and new inflows through ETFs are helping to sustain this trend. Traders consider the $110,000–$112,000 range of support to be a crucial safety net. Because of the upper resistance zone’s thin market depth, volatility may be triggered by another major sell order or profit-taking.

Current BTC Price Scenario

Investors are keeping a careful eye on whale movements and futures open interest to look for indications of distribution rather than new accumulation. The current price scenario is critical, with Bitcoin fluctuating between $114,000 and $116,000, testing resistance between $115,000 and $117,500. Support is around $110,000 to $112,000, which is crucial to prevent a dip between $100,000 and $105,000.

BTC 1d chart, Source: crypto.news

BTC 1d chart, Source: crypto.news

Upside Outlook

A bullish run above $122,000–$130,000 is probably in store for Bitcoin if it clears and holds above the resistance cluster of $116,000–$117,500, as per the majority of analysts’ Bitcoin outlook. Bullish sentiment is being fueled by stablecoin liquidity, consistent ETF inflows, and positive macro forecasts (such as possible US rate cuts). According to some projections, if these tailwinds line up and momentum picks up speed, the price may extend toward $135,000 to $140,000. The required support for this upside scenario may come from whales and huge holders who keep accumulating.

Downside Risks

Even with the positive scenario, risk is still high, which is why price expectations should not be kept rigid. Should Bitcoin be unable to maintain its position above the $110,000–$112,000 support, a decline may push the price back near $100,000–$105,000. A downturn might be triggered by whales lowering exposure or by big sell orders appearing close to resistance. Furthermore, downside risk might be increased by macroeconomic data weakness, unexpected hawkish Fed actions, or a drying up of liquidity. Derivatives’ shrinking range and increasing leverage also increase the likelihood of abrupt movements in either direction if sentiment changes.

BTC Price Prediction Based on Current Levels

The current price of Bitcoin (BTC) is fluctuating between $110,000, which is the support, and $116,000–$117,500, which is the resistance. The bullish scenario targeting $122,000–$130,000 would be validated by a clean breakout above the resistance zone with conviction in volume, maybe pushing higher depending on macro momentum. Conversely, a decline towards $100,000–$105,000 might result from a collapse below the support level at about $110,000. Though cautiously bullish overall, there is a higher risk of resistance rejection or macro headwinds.

BTC support and resistance levels, Source: Tradingview

BTC support and resistance levels, Source: Tradingview

For the latest Bitcoin price predictions and analysis, visit https://crypto.news/bitcoin-price-prediction-september-15-2025/