Bitcoin’s Fastest Bear Market Hides Potentially Positive Year-End Outcome for BTC

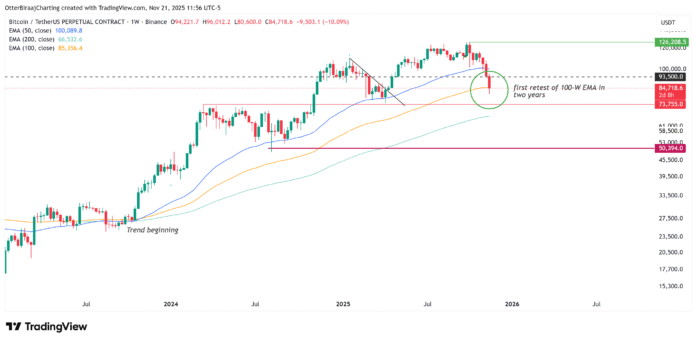

Bitcoin (BTC) has experienced a significant decline, falling to $80,600 on Friday, which extends its weekly losses to over 10%. This downturn has resulted in a monthly decline of 23%, the largest since June 2022. The drop below $84,000 has also led to BTC testing the 100-week exponential moving average for the first time since October 2023, marking the start of the current bull cycle.

One-Week Bitcoin Analysis. Source: Cointelegraph/TradingView

Bitcoin futures liquidations have exceeded $1 billion, underscoring the severity of this downturn, described in the Kobeissi letter as the “fastest bear market ever.” The cryptocurrency market capitalization has fallen 33% since October, marking a rapid structural decline. Record fund outflows and negative ETF inflows suggest ongoing institutional selling pressure.

Cryptocurrency Market Cap Collapses as “Structural” Selling Accelerates

Since October 6, the total crypto market cap has fallen from $4.2 trillion to $2.8 trillion, a 33% decline. The Kobeissi letter called it “one of the fastest-developing crypto bear markets ever,” with selling increasing across all major sectors. The newsletter said digital asset investment products reflected the same stress, with crypto funds seeing $2 billion in weekly outflows, the largest since February.

Crypto asset fund flows as a percentage of fund AUM. Source: Kobeissi letter/X

This was the third consecutive week of net sales, resulting in total outflows of $3.2 billion during the period. Bitcoin accounted for the majority of withdrawals with $1.4 billion in redemptions, while Ether followed with $689 million, representing some of the biggest weekly losses either asset has seen in 2025.

Average Daily Outflows and Assets Under Management

Average daily outflows as a share of assets under management (AUM) reached all-time highs, sending total assets under management down to $191 billion, down 27% from October. Analysts classified this as a clear structural decline and not just a short-term panic.

Inflows from US exchange-traded funds (ETFs) are adding to the pressure. Spot BTC ETF flows remain below zero, deepening the sell-off. Meanwhile, BlackRock’s spot ETF is on track to record its largest weekly outflow ever and is poised to surpass February’s record $1.17 billion.

iShares Bitcoin Trust weekly net inflows. Source: SoSoValue

A Macroeconomic Shift Could Give Bitcoin a Liquidity Edge

While several analysts continued to call for a Bitcoin bottom based on technical charts and on-chain data, Miad Kasravi took a different approach. Kasravi conducted a decade-long backtest of 105 financial indicators and showed that the National Financial Conditions Index (NFCI) is one of the few metrics that reliably leads Bitcoin by four to six weeks during major macroeconomic regime shifts.

National Financial Conditions Index (NFCI) data. Source: X

This dynamic was evident in October 2022, when easing financial conditions preceded a 94% recovery, and again in July 2024, when tightening conditions signaled stress several weeks before Bitcoin’s rise from $50,000 to $107,000.

Currently, the NFCI is at -0.52 and trending downwards. Historically, every 0.10 point drop in the index has been accompanied by an increase of around 15-20% in Bitcoin, with a deeper move towards -0.60 typically marking an acceleration phase. December also brings a major catalyst: the Federal Reserve’s plan to convert mortgage-backed securities into Treasury bonds.

Kasravi noted that while the operation is not called quantitative easing (QE), the operation could inject liquidity in a similar way to the “non-QE” event in 2019 that preceded a 40 percent Bitcoin rally.

Should the NFCI continue to decline through mid-December, it would signal the start of a new liquidity expansion window. Based on the index’s consistent lead time of four to six weeks during past regime changes, Bitcoin’s next major cyclical move would occur in early to mid-December 2025, representing a potentially significant inflection point for market participants tracking macroeconomic conditions.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision.

For more information, visit https://cointelegraph.com/news/bitcoin-s-fastest-bear-market-hides-potentially-positive-year-end-outcome-for-btc