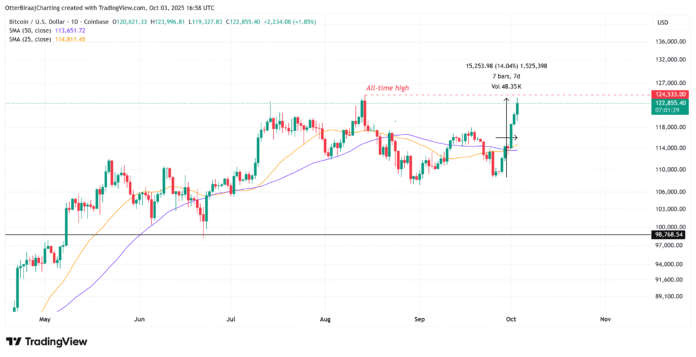

Bitcoin’s recent price surge has left many in the cryptocurrency community stunned, with the digital asset gathering by 14% in a week to reach a staggering $124,000. This significant increase has been observed amidst the closure of the US government, which has seemingly had little impact on the market’s upward trajectory.

Key Drivers of Bitcoin’s Price Increase

Several factors have contributed to Bitcoin’s remarkable rise, including a substantial purchase of $1.6 billion, as revealed by onchain data. Additionally, the Coinbase Premium Gap, which measures the price difference between Coinbase and Binance, has been recorded at $92, indicating strong demand led by US investors. Analysts believe that this surge in demand, coupled with the current macroeconomic conditions in the US, has created a perfect storm for Bitcoin’s price to skyrocket.

According to Bitfinex analysts, “Bitcoin’s movement to a new all-time high seems really organic. We suspect that Trump’s announcement that potentially a stimulus check for every citizen financed by tariffs could also be used, could also contribute to a further increase in Bitcoin.” They also noted that “macro-conditions are still supportive, with inflation loosening and the Federal Reserve introducing a more dovish attitude that increases the appetite for risk assets.”

Onchain Data and Market Analysis

Onchain data has confirmed that the increase is driven by strong demand, with a taker buy volume tip of over $1.6 billion being bought in an hour across all exchanges. The Coinbase Premium Gap, which measures the price difference between Coinbase and Binance, has been recorded at $91.86, signaling a strong US-led demand. Analyst Burak Kesmeci explained that US investors are paying almost $92 more per Bitcoin on Coinbase, indicating a robust demand.

Bitcoin one-day chart. Source: CoinTelegraph/Tradingview

Price Discovery Outlook for Next Week

As Bitcoin presses near record highs, analysts are awaiting a price discovery next week. Crypto Trader Jelle noted, “120,000 US dollars will be supported today. Keep it over the weekend and I expect the price discovery to be resumed in the next week.” Trader Rekt Capital described this phase as the “Price discovery of phase 3” of the current cycle, the breakout phase, in which new heights are determined.

Bitcoin Coinbase Premium Gap. Source: Cryptoquant

Analyst Skew pointed out that demand is robust, but severe sell orders are around $130,000, which ensures the next key resistance. The analyst also highlighted the strong US inflows via Coinbase and a large “risk-on” positioning in Binance, emphasizing that the coming daily closures will be decisive in confirming whether BTC can maintain its dynamics.

Bitcoin market analysis by SKEW. Source: x

This article does not contain investment advice or recommendations. Every investment and trade movement involves risk, and readers should conduct their own research before making a decision. For more information on Bitcoin’s price surge and market analysis, visit https://cointelegraph.com/news/bitcoin-chases-new-highs-as-crypto-market-cap-crosses-dollar4-21t