Bitcoin Reaches New Heights: Record Inflows and the “Debasement Trade”

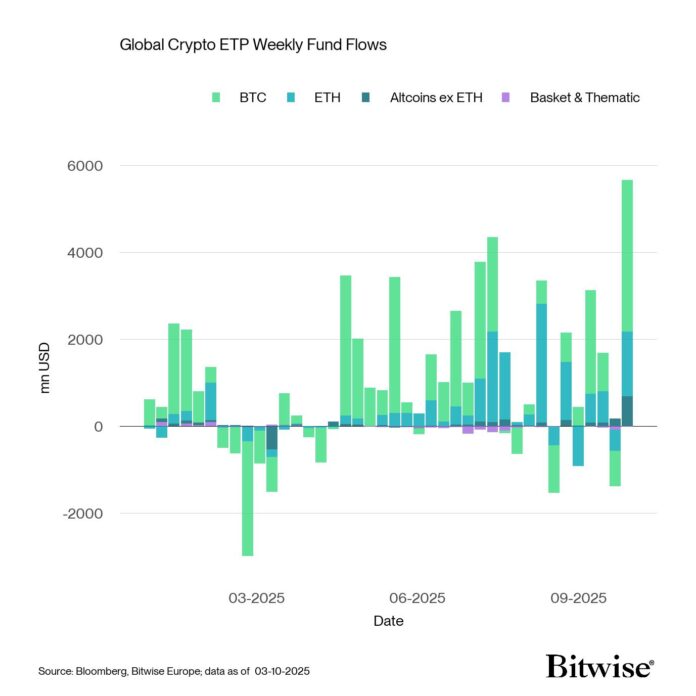

Bitcoin has stormed to a new all-time high of $126,200, supported by a record $5.67 billion in ETP inflows, the largest weekly inflow on record. This surge reflects the return of investor confidence, driven by fiscal and geopolitical uncertainty, and the renewed trust in the “debasement trade” narrative. According to a report by Bitwise, the current crypto rally demonstrates how weakening fiat confidence and increasing macroeconomic uncertainty lead to a structural demand for store-of-value assets like bitcoin and gold.

The report, authored by Director and Head of Research André Dragosch, Senior Research Associate Max Shannon, and Research Analyst Ayush Tripathi, highlights that the US dollar index (DXY) has dropped 10% over the past year, while gold has risen 50%, outpacing bitcoin’s 27% gain over the same period. Many investors now consider BTC as a digital hedge, offering a larger asymmetrical upward trend in the face of currency debasement.

Spot Bitcoin Exchange Fund (ETFs) led the inflows with $3.49 billion, followed by $1.49 billion from Ethereum and $685 million in ex-ETFs. US-based spot ETFs dominated the activity, with Blackrock’s Ishares Bitcoin Trust (IBIT) and Bitwise’s Bitb attracting the majority of new allocations. On-chain data cited in the report shows over 49,000 BTC were withdrawn from exchanges, indicating sustainable, rather than euphoric, progress.

Fiscal Fragility Drives Bitcoin’s Long-Term Growth

Bitcoin proponent Paul Tudor Jones has reiterated the growing view that the US financial landscape is now the most important macro driver for risk assets. With the federal government’s swelling debt and annual interest costs exceeding $1 trillion, markets are increasingly pricing in continued monetary easing, historically a tailwind for BTC. CoinTelegraph reported that foreign owners of US treasury and the dollar’s weakening are contributing to the capital rotation to “hard assets” like Bitcoin.

Tudor’s comparison with the bull cycle of the late 1990s found that the lack of euphoria and persistent institutional inflows indicate that the rally has room to run. Essentially, fiscal fragility, expectations of easing, and declining real yields converge to create an environment ripe for Bitcoin’s structural growth. However, not all on-chain signals align with this narrative. Bitcoin researcher Axel Adler Jr. pointed out that small transaction activity, normally driven by retail traders, has been steadily decreasing since spring 2024, even as Bitcoin’s price reaches new highs.

This deviation between price increase and decreasing retail participation suggests that the current rally is being driven disproportionately by institutional investors, indicating retail exhaustion beneath the surface of Bitcoin’s bullish dynamics. For more information, read the full report on CoinTelegraph.