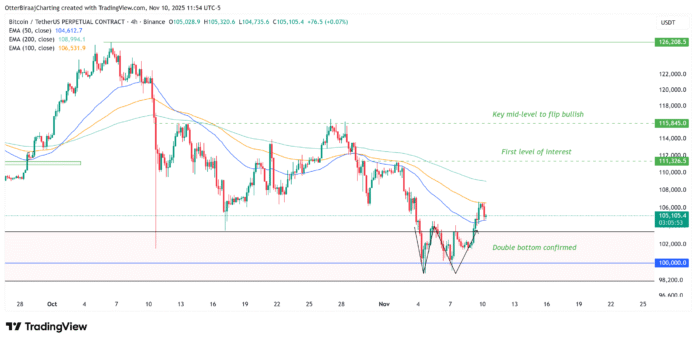

The Bitcoin market has been abuzz with the recent formation of a double bottom pattern, which could potentially propel the cryptocurrency towards the $110,000 mark. This bullish momentum is further supported by the daily order block between $98,100 and $102,000, where Bitcoin has repeatedly tested the $100,000 zone before recovering. The four-hour chart also displays a bullish structural break, with Bitcoin facing resistance near $111,300, a level that could be tested if short-term momentum continues.

However, on-chain data suggests that this progress may not be so easy to achieve. According to Glassnode, Bitcoin has recovered from the 75th percentile cost base near $100,000, with the next significant hurdle lying near the 85th percentile cost base, around $108,500. This level has historically acted as resistance during rebound moves, as it represents the distribution of costs across the market.

Short-term volatility and the impact of stablecoins

Cointelegraph noted a potential liquidity pullout above $115,000, consistent with daily resistance levels, with long-side liquidity depleted at around $100,000. Additionally, a CME gap from $103,100 to $104,000 remains a key near-term risk, which could trigger a short-term decline. These gaps are often “filled” as traders revisit these levels, suggesting that BTC could pull back briefly before resuming its uptrend.

The buildup of stablecoins and the stress of short-term holders also indicate short-term volatility. CryptoQuant data suggests that the stablecoin supply ratio (SSR) fell from over 18 at the beginning of the year to 13.1, one of the lowest levels in 2025. This decline suggests increasing stablecoin reserves relative to Bitcoin’s market capitalization, a sign that off-chain liquidity accumulation is awaiting a market signal.

Short-term holder inflows and their impact on the market

Crypto analyst Darkfost observed a 40% increase in short-term holder (STH) inflows to Binance since September, from 5,000 BTC to 8,700 BTC. With the realized price of STHs around $112,000, many remain underwater and increasingly reactive to short-term volatility. Selling pressure from this cohort often precedes mid-cycle shocks before a broader upward move, creating short-term instability.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information on the Bitcoin market and its analysis, visit https://cointelegraph.com/news/bitcoin-double-bottom-eyes-dollar110k-but-cme-gap-may-postpone-rally?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound