Bitcoin’s Risk-Off Signals Raise Concerns Despite Price Stability

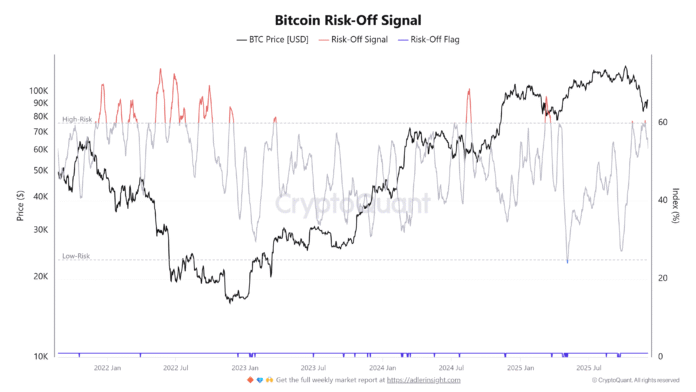

Despite Bitcoin (BTC) maintaining a price above $90,000, various data points suggest that the cryptocurrency’s market is still flashing warning signs. CryptoQuant’s multimetric risk-off oscillator remains near the “high-risk” zone, a level that has historically preceded corrections and reduced the likelihood of a sustained uptrend. This indicator combines six key metrics – downside volatility, upside volatility, foreign exchange inflows, funding rates, open futures contracts, and market capitalization behavior – to provide a comprehensive assessment of market fragility.

Bitcoin risk off signal. Source: CryptoQuant

Key Indicators Point to Structural Weakness

Bitcoin researcher Axel Adler Jr. notes that the profit/loss value has fallen to -3, indicating an extreme concentration of unprofitable UTXOs. Historically, this level has coincided with bearish regimes and extended cooling periods. The current decline of -32% exceeds normal cycle declines (-20%-25%) but remains above capitulation thresholds (-50% to -70%), placing Bitcoin in a vulnerable “intermediate zone.” Adler suggests that unless macroeconomic conditions and on-chain profitability improve, the likelihood of a sustained downtrend remains high, despite the price stabilizing around $90,000.

Percentage decline in Bitcoin price from all-time high to historic lows. Source: Axel Adler Jr.

On-Chain Data Offers a Glimmer of Hope

Glassnode’s on-chain data provides a slightly more optimistic outlook. The analytics platform notes that Bitcoin’s recent decline triggered the largest increase in realized losses since the FTX collapse in 2022, driven predominantly by short-term holders (STHs). However, long-term holder (LTH) losses remain comparatively muted, a dynamic that has historically reflected the resilience of core holders and sometimes cushioned deeper capitulations in past cycles.

The Battle for $100,000: Momentum vs. Trend

A CryptoQuant analyst describes Bitcoin’s approach to $100,000 as a “psychological turning point.” While a breakout could spark renewed momentum, possibly aided by a Federal Reserve interest rate cut, large round numbers often lead to volatility and failed attempts. The growth rate difference (market capitalization vs. realized capitalization) remains at -0.00095, indicating that market capitalization is shrinking faster than realized capitalization. With BTC currently at $91,000, the analyst leans towards structural weakness rather than trend expansion.

The difference in BTC growth rate (market cap vs. realized cap). Source: CryptoQuant

Bitcoin futures trader Byzantine General also identifies fluctuating price action for BTC, stating: “$BTC is struggling a bit here at this key resistance level. If it breaks through, it could move above 100,000 very quickly, but if it actually rejects here, then we’re probably stuck in this 92,000-82,000 area for a while.”

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information, visit https://cointelegraph.com/news/bitcoin-risk-off-signals-fire-but-traders-say-sub-dollar100k-btc-is-discounted