BNB (BNB) has regained its bullish momentum, recovering over 13% from a local low near $800. As of Wednesday, the price has traded above $910, with a potential rise back towards $1,000 on the horizon. This upward trend is supported by several key indicators, including a double bottom pattern, a falling wedge breakout, and significant liquidation pressure.

Key Indicators and Trends

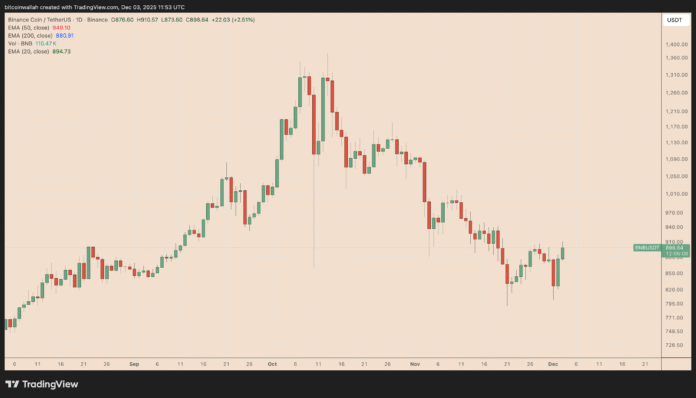

A closer examination of the BNB/USD daily chart reveals a double bottom pattern on the four-hour chart, which has formed near the $800-$820 demand zone. This pattern typically signals a trend reversal when the price breaks out above the pattern’s neckline, currently situated near the $900 to $920 resistance area. A confirmed breakout above this area could initiate a short-term rally towards $1,020 in December, where the 0.382 Fibonacci retracement line converges.

BNB/USD daily chart. Source: TradingView

Double Bottom Pattern and Its Implications

The double bottom pattern is characterized by two similar lows (Bottom 1 and Bottom 2), followed by a significant rebound, indicating that selling pressure is easing and dip buyers are stepping in. The structure typically signals a trend reversal when the price breaks out above the pattern’s neckline. A confirmed breakout above this area could initiate a short-term rally towards $1,020 in December.

BNB/USDT four-hour chart. Source: TradingView

Liquidation Pressure and Its Impact on Price Momentum

BNB’s liquidation heatmap on CoinGlass showed approximately $112.28 million in short liquidation leverage near $1,020, suggesting that price momentum could accelerate to this level in December. Liquidation heatmaps show where leveraged traders are likely to be forced out of their positions. In this case, many traders appear to be betting against BNB near current levels.

Binance BNB/USDT liquidation heatmap (1 month). Source: CoinGlass

Falling Wedge Breakout and Recovery Chances

BNB has emerged from a multi-week falling wedge, a structure that typically resolves bullishly after extended sell-offs. On the four-hour chart, BNB broke the descending upper trend line of the wedge in late November, but briefly pulled back to retest it as support, a frequent and constructive confirmation of the breakout.

BNB/USDT four-hour chart. Source: TradingView

The successful recovery after this retest suggests that buyers are regaining control. The wedge’s measured upside target suggested the $1,100-$1,115 area in December if the breakout continues. However, a sustained move back below the former resistance-support zone would weaken bullish sentiment, risk trapping breakout traders, and delay any sustained recovery above $1,000.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information on BNB’s price movement and market analysis, visit https://cointelegraph.com/news/can-bnb-price-retake-1k-this-week?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound