Bitcoin Price Faces Downside Risk as US Traders Turn Bearish

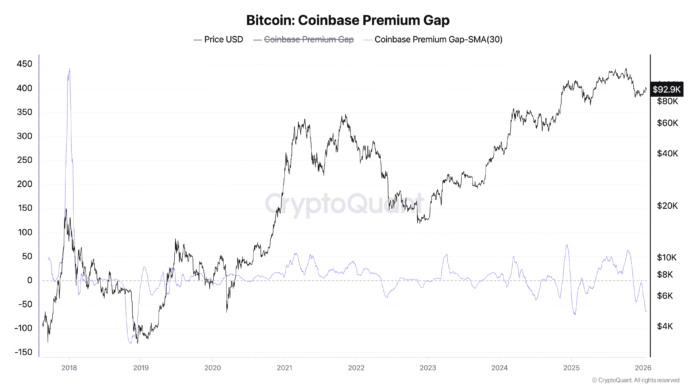

Bitcoin (BTC) is facing increasing downside risk as macro pressure and weak technicals point to a possible drop toward $80,000 on a rising-wedge breakdown. The cryptocurrency witnessed its lowest Coinbase Premium Gap (CPG) in a year, a sign that US-based investors were applying strong selling pressure relative to global markets.

The CPG tracks the price difference between Bitcoin’s USD pair on Coinbase and its USDT pair on Binance. When the gap turns deeply negative, it means Bitcoin is trading at a lower price on Coinbase, suggesting US traders are selling more aggressively than their offshore counterparts. According to analyst Mignolet, the CPG low formed during a US market holiday, when spot Bitcoin ETFs were inactive, indicating that the selling pressure did not come from spot Bitcoin ETFs, but from US whales operating outside of traditional funds.

Holiday Selling Pressure and Technical Analysis

As of Monday, Bitcoin’s 30-day average CPG fell to about −63.85, its lowest level since January 2025. This reading preceded a BTC price drop to roughly $78,350 from above $102,000 in just four months.  Bitcoin’s Coinbase Premium Gap vs. BTC price. Source: CryptoQuant

Bitcoin’s Coinbase Premium Gap vs. BTC price. Source: CryptoQuant

The timing of the CPG low also coincided with a broader shift in market sentiment, as US futures fell after President Donald Trump escalated tariff threats against European Union nations that resisted his plans to take control of Greenland. At the same time, traditional safe-haven assets such as gold and silver rallied, signaling capital rotation away from risk.  Nasdaq futures vs. gold and silver daily chart. Source: TradingView

Nasdaq futures vs. gold and silver daily chart. Source: TradingView

Technical Indicators and Downside Risk

Bitcoin’s daily chart shows a rising wedge formation, a pattern that often signals weakening upside momentum during corrective rebounds. Price printed higher lows, but within narrowing trendlines, reflecting shrinking buying conviction. The structure increases the risk of a downside breakdown if macro pressure persists and pushes the CPG deeper into negative territory.  BTC/USD daily chart. Source: TradingView

BTC/USD daily chart. Source: TradingView

A confirmed loss of wedge support would likely trigger a measured downside move, as is typical in rising-wedge breakdowns, exposing Bitcoin to accelerated selling toward prior demand zones. Based on the pattern’s height and recent historical reactions, the $80,000–$78,000 area emerges as the primary downside target. For more information, read the full article on Cointelegraph.