Canaan’s Nasdaq Listing in Jeopardy: A 180-Day Countdown Begins

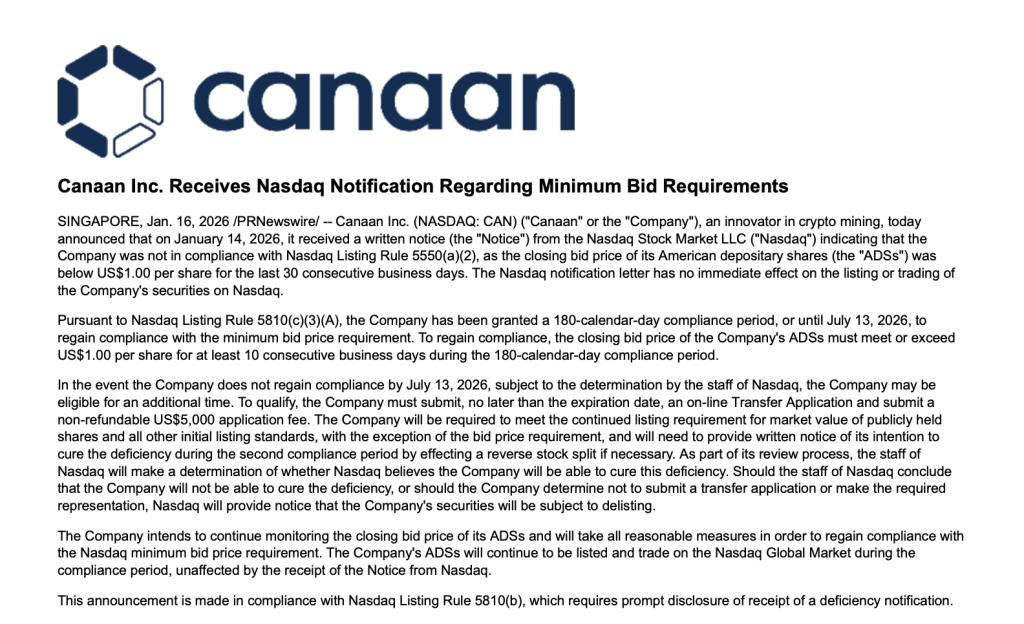

Canaan, a leading Bitcoin mining hardware manufacturer, is facing a critical challenge as it struggles to maintain its listing on the Nasdaq stock exchange. The company has been given a 180-day notice to comply with the exchange’s minimum listing requirements, which could potentially lead to delisting if not met. This development highlights the intense pressure on publicly traded cryptocurrency companies, particularly those involved in mining, as they navigate the complexities of regulatory compliance and market volatility.

The warning from Nasdaq stems from Canaan’s share price, which has been trading below the minimum requirement of $1 for 30 consecutive business days. As a result, the company must now ensure that its shares close at or above $1 for at least ten consecutive business days to regain compliance. Failure to do so may lead to further action, including a potential reverse stock split, to avoid delisting.

Canaan’s Share Price Struggles Continue

At the time of writing, Canaan’s shares are trading at approximately $0.79, well below the required threshold. The stock has not closed above $2 since October and has lost over half of its value in the past year, reflecting a broader trend of investor skepticism towards cryptocurrency-related companies. Despite occasional short-term rebounds, the overall trend remains negative, with the stock struggling to regain traction.

Canaan’s financial performance has shown signs of improvement, with the company reporting its largest hardware purchase in three years in October 2025. However, this positive news has not translated into sustained stock strength, reflecting broader concerns about the company’s profitability and long-term viability.

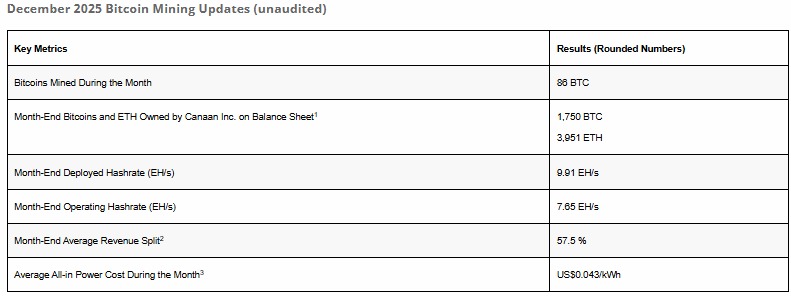

Operational Growth, But Profitability Remains Elusive

Despite growing its revenue and expanding its operations, Canaan continues to struggle with profitability. The company’s net loss in the third quarter of 2025 was $27.7 million, with operating and net margins remaining sharply negative. Analysts do not expect consistent profitability until 2027, highlighting the challenges faced by the company in achieving sustainable growth.

Canaan’s situation is not unique, with other cryptocurrency-related companies facing similar challenges. The company’s $30 million share repurchase program, announced in December, demonstrates management’s confidence in the stock’s value. However, the lack of sustained profitability and stable investor demand has limited the program’s impact on the stock price.

As Canaan navigates this critical period, investors and industry observers will be closely watching the company’s progress. With the 180-day countdown underway, the company must demonstrate its ability to regain compliance and achieve sustainable growth to avoid delisting and maintain investor confidence. For more information, visit https://cryptonews.com/news/canaan-nasdaq-delisting-warning-bitcoin-miner/