Cryptocurrency Market Developments: Litecoin, HBAR, and Bitgo

Analysts in the cryptocurrency space have reported that Canary Capital’s funds for Litecoin and HBAR are set to be utilized following the reopening of the US government. Additionally, Bitgo has secured a Vara license, and Dubai’s regulatory authority has announced a wave of enforcement measures. Meanwhile, the parent company of the NYSE, Intercontinental Exchange, has invested $2 billion in Polymarket, a cryptocurrency-based prediction market, at a valuation of $9 billion.

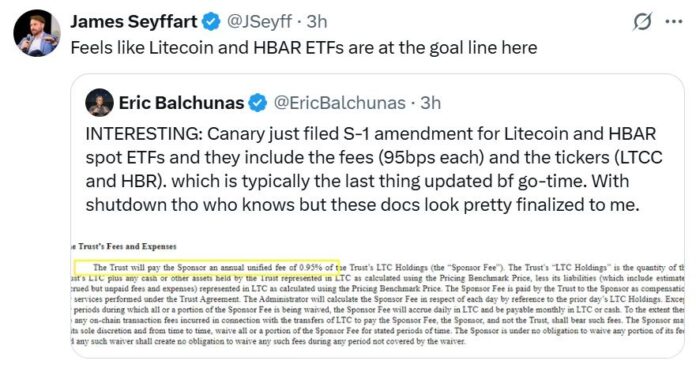

The developments in the cryptocurrency market are significant, with various companies making strides in the industry. Canary Capital’s ETFs for Litecoin and HBAR are nearing approval, with the company having submitted final details, including a fee of 0.95% and tickers “LTCC” and “HBR” for the respective ETFs. According to Bloomberg ETF analyst Eric Balchunas, the documents appear to be complete, but the approval process may be delayed due to the US government shutdown.

Source: James Seyffart

Bitgo Secures Vara License Amidst Regulatory Crackdown

Bitgo, a digital asset infrastructure company, has announced that it has received a broker-dealer license from the Virtual Assets Regulatory Authority (Vara) in Dubai. This license enables the company to offer regulated trading in digital assets and brokerage services for institutional clients. The development comes amidst a wave of enforcement measures announced by Vara, including fines for 19 companies engaging in non-licensed activities in the virtual assets space.

Ben Choy, General Manager of Bitgo Mena, stated that the approval enables the company to operate with greater scope, trust, and integrity, highlighting the growing dynamics in Dubai’s digital asset ecosystem. The license was announced less than 24 hours after Vara’s enforcement measures were made public, which included actions against the Ton DLT Foundation and Hokk Finance.

Source: Bitgo

Intercontinental Exchange Invests $2 Billion in Polymarket

Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE), has invested $2 billion in Polymarket, a cryptocurrency-based prediction market. The deal values Polymarket at $9 billion, post-money. According to Polymarket X, the investment is a significant step in combining the traditional financial landscape of the US with the cryptocurrency industry.

Polymarket is a cryptocurrency-based prediction market that allows users to buy and sell “shares” in real-event outcomes, such as elections, sports, and cryptocurrency prices. The market prices reflect the implicit probabilities of the events, and transactions are typically handled using stablecoins. However, access to the platform is restricted for US users due to regulatory reasons.

Source: Polymarket

For more information on the latest developments in the cryptocurrency market, visit https://cointelegraph.com/news/what-happened-in-crypto-today?utm_source=rss_feed&utm_medium=rss_tag_litecoin&utm_campaign=rss_partner_inbound